Disruption is here to stay – that continues to be the subtext of a glitzy annual crypto conference in the Swiss Alps. finews.com looks at how four prominent Swiss bankers are approaching the challenge.

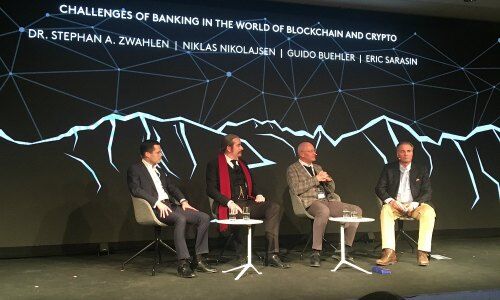

The panel, «Challenges of banking in the world of blockchain and crypto», was one of the hottest tickets at an annual confab of crypto enthusiasts and potential investors in St. Moritz, Switzerland. The topic is virulent – and all the panelists were bankers.

Niklas Nikolajsen, who founded Bitcoin Suisse in 2013, is an aspiring banker for now – the crypto firm is applying for a banking license with Swiss regulator Finma. Other panelists, like Stephan Zwahlen who runs Swiss private bank Maerki Baumann, represent the younger guard of Swiss bankers seeking to transform older firms in order to survive.

Eric Sarasin, a scion of the Basel private banking dynasty, went from deputy CEO of the eponymous bank to private financier of fintech and crypto start-ups (and an organizer of the annual pre-Davos crypto event). Guido Buehler is a traditional banker who forged a career at UBS before co-founding Seba Crypto.

Nikolajsen represents the group's pioneer and challenger with the vastest experience in crypto financial services – but a banking novice. Traditional banking's major challenge is «decentralized» finance: open-sourced platforms running on blockchain technology which can potentially handle payments, credit, or foreign exchange transactions quicker, more securely, and faster than finance providers.

finews.com looks at how each of the bankers wants to tackle the challenge differently.

- Page 1 of 3

- Next >>