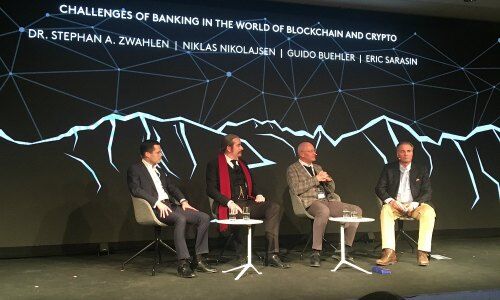

1. Eric Sarasin

The veteran Swiss wealth manager has the clearest position of the four: Sarasin is no longer in banking, and has shifted his profile into a purely disruptive one. If the risks to investors in crypto and blockchain are considerable, the 62-year-old «privatier» only answers to his family. Sarasin is clearly an acolyte of decentralized finance – he openly expresses his relief at not being a banker anymore.

2. Stephan Zwahlen

The Swiss native arguably has the toughest job of the quartet: Zwahlen must lead into the future a 90-year-old private bank whose main attributes have long been stability and tradition. That's a problem: the average age among Maerki Baumann's well-heeled clientele is more than 65, and efforts to attract a younger generation had foundered.

Then roughly 18 months ago, news spread that Zurich wealth manager would start accepting cryptocurrencies. That wasn't strictly the case, but it was enough to rouse attention among the highly-desirable segment of young, affluent, and educated clients. Maerki Baumann now offers corporate banking services for crypto businesses, and supports fledgling firms in their initial coin or security token offerings.

This spring, the 42-year-old CEO wants to add brokerage and custody services. «I'd say to the bankers who think the last ten years were tough – just wait for the next ten,» Zwahlen said. He expects change as profound as Switzerland's abandonment of long-held banking secrecy laws. He is insistent that the crypto strategy not harm Maerki Baumann's stability of reputation. Also of key importance: «Don't lose the customer interface.»