Switzerland's efforts to bolster its standing as an asset management center is shifting the league tables. A new study shows which names rank the strongest.

Swiss boutique Pictet ranks fourth in an annual Fund Buyer Focus compiled by U.S.-based Broadridge of strongest brands in asset management. The study polls roughly 850 fund selectors and purchasers on attractiveness of investment strategy, client focus, and innovation speed as well as factors like the firm's solidity, stability of investment teams, and whether principles of sustainability are considered.

Industry Giants

(Click image to enlarge

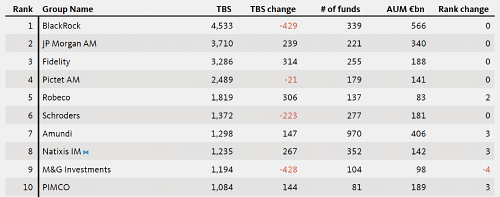

Broadridge compiles a so-called total brand score based on an amalgam of the factors: internationally, Blackrock leads the league table, ahead of J.P. Morgan and Fidelity. Pictet's fourth-place perch is the most prominent Swiss house in the top-ten, which is rounded out by Robeco, Schroders, Amundi, Natixis Investment Managers, M&G, and Pimco.

Other Swiss houses also hold a prominent spot: UBS' asset management arm at 19th, and Vontobel in 21st. Credit Suisse's fund arm made 33rd; GAM in 44th, die Union Bancaire Privée at 47th, followed by Bellevue Asset Management. Edmond de Rothschild rounds out the ranking in 50th place.

Leading Swiss Names

(Click image to enlarge)

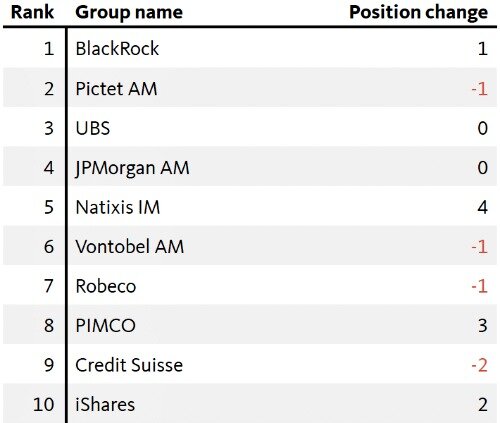

Splitting out Switzerland alone, Blackrock edges out Pictet for the top spot - a reflection of the U.S. house's scale, according to the study's authors, while Pictet shines with investment skill, attractive investment strategy, innovation. Unlike its U.S. peer, Geneva-based Pictet doesn't have the sheer volume of Blackrock, nor the marketing resources.

UBS and J.P. Morgan's asset management arm nabbed third and fourth place, respectively, which is unchanged on the year. Natixis stole a march by climbing from ninth place last year to fifth. How did the French boutique, practically unknown in Switzerland several years ago, make a name for itself in the Swiss market so quickly?

Fifth Place Coup

Natixis is less a fund house than a harbor for 15 investment companies focused on specific investment categories and strategies. With subsidiary Mirova, Natixis has put particular emphasis on ESG investments, or those in line with environmental, societal, or governance criteria.

Switzerland's efforts to bolster its standing in asset management represent a bid to find new sources of profits amid the decline of traditional private banking. The bid is complicated by an era of persistently low to negative interest rates by central banks as well as the emergence of sustainable strategies into mainstream investing.