The dominant payment app in Switzerland, Twint, is looking to accompany its users when they travel abroad as well as expanding its reach at home.

The Swiss banks’ payment app Twint mostly stays with friends, with 65 percent of all users sharing bills or settling up with each other via the ap, CEO Markus Kilb told journalists Wednesday.

Women «Twint» More

Twint has a lot of friends. The company says that 77 percent of all smartphone payments in Switzerland are carried out using it, with 3.5 million Swiss users of whom 500,000 are very active, with more women than men in this category.

However, the time has come to step out into the big, wide world. Kilb said Twint is now planning to accompany its Swiss users abroad. From the spring of 2022 it should be possible to «twint» in some neighboring countries. These should be followed by other European countries.

EMPSA, QR Code

Twint’s plan is relying on the European Mobile Payment Systems Association, of which it was a co-founder in 2019 and which now combines contactless payment systems from 15 countries. France and Spain are not members.

Via EMPSA Twint users will, in Germany for example, be able to scan a QR code into their phones and activate a payment between their Swiss bank and the German business. The Twint CEO said the simplicity of this could be compared with mobile telephone roaming.

The fintech is also thinking of broadening its horizons at home.

Insurance Sales

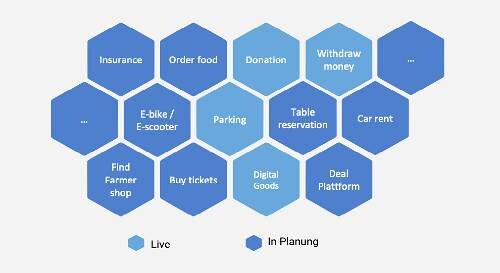

The focus will be on the so-called market place on the app’s «Twint +» function. The plan is to make a variety of products available here such as insurance, a ticketing service, food delivery as well as deeply discounted special offers (see graphic below).

The market place would be given a major enhancement from, Kilb said. Until then it has a contactless parking meter function, digital vouchers, donations and cash withdrawal via the Sonect app.

Complete Integration with Banks

Kilb was unwilling to elaborate on the move into bancassurance. He said Twint would start the service up with one partner and then other insurers could join. That way the Swiss bank’s app would also become the Swiss insurers’ app.

Twint’s shareholders include banks UBS, Credit Suisse, Raiffeisen, the Zurich Cantonal Bank, the Vaudois Cantonal Bank and Postfinance as well as Swiss exchange operator SIX and the French payment terminal operator Worldline.