The Swiss heritage brand's new ownership flags plans for a public listing. Not before late 2023 however.

Partners Group and CVC see watchmaker Breitling as an initial public offering candidate, according to an interview with the «Neue Zuercher Zeitung» (behind paywall, in German) Tuesday.

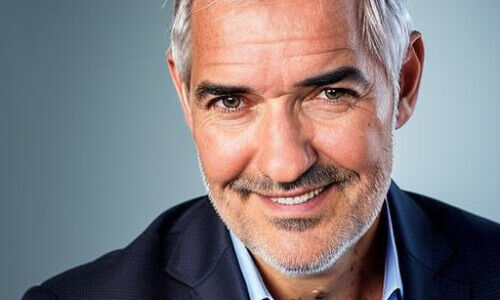

Breitling's IPO won’t happen before 24 months from now, Partners Group’s co-founder Alfred Ganter tells the Swiss newspaper. He was speaking as the Baar-based private equity company bought a «significant» minority stake in the Swiss watchmaker.

Management Alliance

Under the new ownership structure, Ganter will join CVC on Breitling’s board.

«With CVC and Partners Group we have a strong alliance to accomplish our ambitious targets to realize our immense potential to become one of the undisputed leaders in the Swiss watch industry,» Breitling CEO George Kern said in the statement.

Post-Pandemic Pick-Up

Breitling's sale process comes against the backdrop of a pick-up in luxury watch sales, following a pandemic-induced dip last year. The Grenchen-based watch firm was family-controlled until CVC entered the ring four years ago – reportedly for more than 800 million euros ($950 million).

It is one of the few Swiss watchmakers that has not been taken over by one of the larger luxury firms such as LMVH, Kering, or Richemont. Partners Group lists growing direct-to-consumer sales channels, expanding the retail network and improving operational efficiency, as some key initiatives for the watchmaker.