Cryptocurrency player Binance is going old school, making a $200 million investment in media brand Forbes via a SPAC investment.

Forbes is set to go public by the end of the first quarter via an acquisition by Magnum Opus Acquisition Ltd., which is a special purpose acquisition company (SPAC) already listed on the New York Stock Exchange.

Binance is investing in the deal via a $200 million commitment to the total $400 million private investment in public equity, or PIPE, Forbes said in a press release Friday. PIPEs are common in SPAC deals as the SPAC entity may not have raised enough equity initially to complete its planned business combinations.

The deal’s PIPE size will remain at $400 million, with Binance taking over existing subscription agreements, the statement said.

Playing up digital assets

Under the deal, Binance is expected to advise Forbes on its digital assets and Web3 strategy, the statement said. Web3 is a conceptual new iteration of the world wide web based on blockchain technology, but it has not yet been implemented.

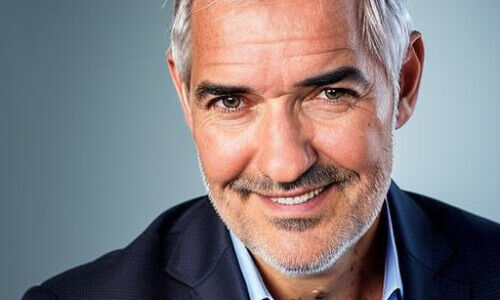

«Forbes is committed to demystifying the complexities and providing helpful information about blockchain technologies and all emerging digital assets,» said Mike Federle, CEO of Forbes, in the statement. «With Binance’s investment in Forbes, we now have the experience, network and resources of the world’s leading crypto exchange and one of the world’s most successful blockchain innovators.»

Blockchain and Media

Changpeng «CZ» Zhao, founder and CEO of Binance, added that media is an essential element for building widespread consumer understanding of blockchain technologies.

«We look forward to bolstering Forbes’ digital initiatives, as they evolve into a next level investment insights platform,» Zhao said in the statement.

As part of the deal, Patrick Hillmann, chief communications officer for Binance, and Bill Chin, head of Binance Labs, which is Binance’s venture capital arm and incubator, will join Forbes’ board of directors, the statement said.

The overall acquisition of Forbes values the combined company at an implied pro forma enterprise value of $630 million, Forbes has said previously.