For the past 200 years, Switzerland has been the number one financial center to attract wealth from other countries. Yet, it will unlikely be able to hang on to its pole position, as wealth increasingly flows to other places. And this isn’t the only area where Switzerland is falling behind.

Last year’s soaring equity markets drove global wealth up 10.6 percent to $530 trillion, marking the world’s highest growth rate in twenty years, Boston Consulting Group (BCG) found in its «Global Wealth Report 2022» released Thursday.

Despite current geopolitical and economic factors including Russia’s invasion of Ukraine and inflation, BCG expects approximately $80 trillion to be created in new wealth globally over the next five years - with wealth rising in all regions - proving that «wealth development is resoundingly resilient,» Anna Zakrzewski, co-author of the report said.

Making Way for the U.K.

Although Switzerland reaped the gains from 2021's buoyant financial markets, growing 5.5 percent, the report points to more challenging years ahead for the financial center.

A big blow will come in the next four years when Switzerland falls out of the world's top three financial centers, into fourth position behind the U.S., Hong Kong, and the U.K. in terms of onshore, cross-border and financial assets held. While Swiss financial assets are expected to grow 2.8 percent by 2026, the report says assets in the U.K. will rise by 3.3 percent (see below).

Another Hit Next Year

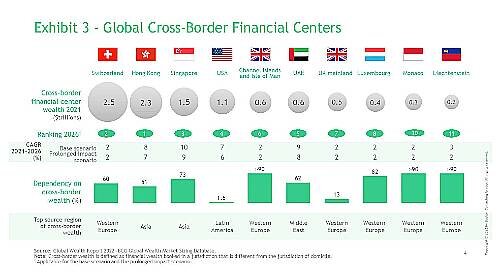

Switzerland will take another hit next year when Hong Kong overtakes it as the top financial center for cross-border wealth, ending Switzerland’s 200-dominance as the world's strongest magnet for foreign wealth.

(Click graphic to enlarge)

The explanation for this shift lies in the wealth development in the places where assets, contributing to Switzerland’s cross-border wealth pool, originate from.

Surpassing Switzerland

In past years, asset inflows from Central and Eastern European countries, in particular, have contributed to Switzerland’s cross-border center. As countries in this region and in Western Europe, face lower increases in wealth, they will be transferring less to Switzerland. Still, Switzerland’s cross-border assets are expected to lie at $2.8 trillion in 2026.

Cross-border assets flowing into Hong Kong, on the other hand, coming mainly from Greater China, are expected to surpass Switzerland next year rising to $3.4 trillion by 2026, the report said.

More Digitization

Outside of the business with high-net-worth and ultra-high-net-worth clients, the opportunities for wealth managers liein the country's 4.7 trillion Swiss francs onshore wealth.

To access this onshore pool effectively, will require more digitization and personalization of products, considering that these are the two areas where top Swiss performers have been able to distinguish themselves in the recent past, as the report showed.