Private investments have become more relevant in a high inflationary environment as a diversified private market portfolio historically offered enhanced protection to the purchasing power of investors compared to a traditional equity bond portfolio.

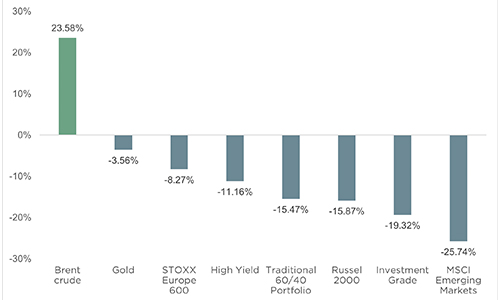

Amidst sustained macroeconomic and stock market volatility, public markets have been significantly affected since the beginning of the year.

Investors in the public market scrambled to find a hedge as the downturn spread to all public assets and even a traditional 60/40 portfolio struggled to protect investors.

Public Markets YTD Performance

(Source: Bloomberg, as of November 2022; click to enlarge)

Central banks have employed aggressive monetary tightening to control inflation, but market volatility is expected to remain high and risky assets as well as valuations will remain under pressure. This is opening more opportunities and appetite for private markets.

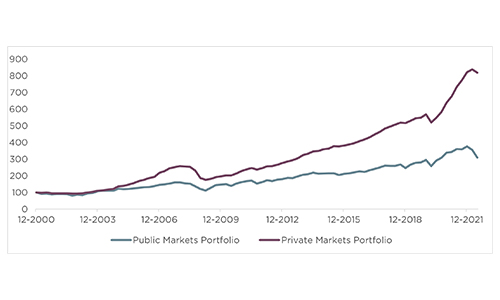

Over the past two decades, a diversified private market portfolio1 has outperformed a traditional 60/40 equity bond portfolio while having lower risk, highlighting the long-term premium features of private markets.

Private Markets Outperformance Over The Last Ten Years

(Source: Bloomberg; Cambridge Associates. Data as of June 2022; click to enlarge)

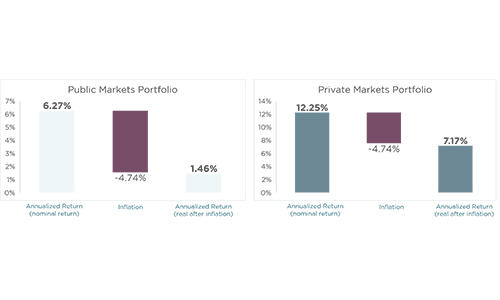

In addition, private investments become even more relevant in a high inflationary environment as a diversified private market portfolio historically offered enhanced protection to the purchasing power of investors compared to a traditional 60/40 equity bond portfolio.

Private Markets Portfolio Maintains the Purchasing Power of Investors

(Source: Bloomberg; Cambridge Associates. Data as of June 2022; click to enlarge)

Note: Inflation is an average of the US CPI over the last 2 years.

Private Market Investing Through the Decades

Despite the growing popularity of private markets, many investors must be selective in identifying quality private investments and plan granular allocations to capture opportunities. Throughout its 18 years of experience, the Petiole team has been successful in capturing dislocation in private markets with its dynamic allocation approach through varying economic cycles.

For instance, after the Global Financial Crisis, Petiole increased its exposure to US mid-market private equity co-investments before rotating defensively from mid-market private equity to large-cap buyout co-investments in the US and Europe.

With real estate asset class, the firm also executed different investment strategies tailored across cycles. For example, Petiole rotated from multi-family residential properties investment to focus on commercial value-add properties in the US in 2014, then played defensively through exposure to real estate debt in 2020 and shifted the attention from office to suburban residential in 2021.

Opportunities in the Current Cycle

In the present environment, the firm has identified growing opportunities across the spectrum of private markets - especially in private credit, venture debt and real estate. The current market volatility and the fear of recession are driving a lower appetite for risk assets and lower liquidity in the market.

As a result, many investors find themselves selling their illiquid credit investments at a discount. This, combined with the expansion in spreads, has opened an optimal entry point for the private credit asset class. This kind of positioning is not something unheard of for Petiole, which launched a similar strategy in 2020 around market dislocations due to the COVID-19 crisis.

«At the thick of the pandemic, we focused on US Credit and were able to generate attractive cash yield and total return at a point where interest rates were close to zero,» stated Petiole's Chief Investment Officer Naji Nehme, CFA. On the venture capital side, the drop in valuations makes private companies reluctant to raise money through equity to avoid down rounds.

Thus, a lot of them turn to alternative financing, opening attractive opportunities in venture and growth debt. Such investments allow investors to benefit from senior security with junior pricing and equity upside, providing double-digit returns with enhanced downside protection.

Following the rise in borrowing rates and pullback in lending activity, the real estate transaction market has dried up and valuations are under pressure.

Naji Nehme added: «In the real estate asset class, we have been positioning higher up in the capital structure by participating in real estate credit as opposed to equity. Going into the next cycle, we will look to return to real estate equity investing in fundamentally strong markets, but at more attractive valuations.»

Quality is Key in Private Markets

Finding premium opportunities in this private market asset class can be costly and time-consuming, which is why many investors struggle with adopting to private investments that are inherently opaque and illiquid. Petiole has been enabling qualified investors of varying entry sizes to access quality direct and co-investments in private markets for years with a holistic solution.

Through its long-standing partnership with top-tier sponsors (such as KKR, Blackrock, Apollo) and its rigorous selection process (i.e., an average deal closing rate of 4 percent over the last three years), Petiole invests in exclusive private market transactions with confidence even in times of market uncertainty and extends this access to qualified investors.

To meet the needs of professional clients, Petiole also recently launched a state-of-the-art digital platform, in addition to its existing institutional investment solutions. Platform users can opt for Petiole’s expert advisory services to get a personalized proposal or select investment programs on the platform directly.

Petiole’s unique and diversified programs highlight specific investment goals or strategies. Through Petiole’s services and solutions, qualified investors have access to optimum diversification. To allocate efficiently and successfully in private markets, Petiole invests for the long term, screens for high-quality assets, and allows the compounding of returns to work in its favor.

The company’s ethos encompasses these three pillars – both through Petiole’s innovative digital investment platform or through conventional meetings with institutional clients.

1Consisting of 40% private equity, 30 percent real estate, and 30 percent private debt

- Contact Petiole’s team today to get more information on private market investing.

Petiole Asset Management is a Swiss-based boutique asset manager with $2.1 billion assets under management with headquarters in Zurich. Finma-licensed and regulated to conduct business in Switzerland, the USA, Hong Kong, and the Cayman Islands, Petiole has established solid working relationships with leading global sponsors through successful direct and co-investments over nearly two decades. Visit www.petiole.com to know more about Petiole Asset Management investment solutions and services.

This article has been prepared solely for information and advertising purposes and does not constitute a solicitation, offer or recommendation to engage in financial services of any kind.