The portfolio managers of Rothschild & Co Swiss Small & Mid-Cap Fund unveil their investment philosophy towards quality stocks and reveal what made their strategy so successful in 2023.

Interview with Benjamin Meier and David Windisch, Portfolio Managers of Rothschild & Co LongRun Swiss Small & Mid-Cap Fund

Gentlemen, could you outline the rationale for Swiss equities in general?

Switzerland as a country benefits from a stable political environment, a highly skilled labor force, business-friendly regulation and geographic proximity to large European markets. Swiss entrepreneurs in particular in the industrial sector have always been close to ingenious in developing and engineering leading solutions. The relatively small size of the domestic market means that successful businesses eventually need to turn to foreign markets to continue growing.

There they face local competitors, so their offering needed to be as good and a little better to succeed. Furthermore, over the past decade or so the strength of the Swiss Franc meant that efficiency became key to maintaining competitiveness. Today, you have many market and technology leaders amongst the listed Swiss small and mid-cap businesses.

Could you walk us through your approach to managing Swiss Small and Mid-Cap Equities?

Our strategy revolves around a long-term, bottom-up equity approach. We dive deep into understanding the corporate landscape, valuing, and carefully selecting companies. Our primary focus lies in identifying the highest quality Swiss Small and Mid-Cap companies. We select companies driven by fundamentals, agnostic to our benchmark. This allows us to select outstanding businesses and construct a focused portfolio.

We typically have a high tracking error as we invest in around 20 businesses for the long run, not simply mimicking the benchmark. These businesses are usually Swiss small and mid-cap companies and as such part of the SPI Extra. However, we can deviate and invest up to 15 percent in Swiss-listed businesses outside of the benchmark. This flexibility, for instance, allows us to hold on to wonderful businesses once they are forced out of the benchmark due to changes in their composition.

How do you ensure a robust portfolio given the small and mid-cap nature of the companies?

Our in-depth analysis forms the backbone of our robust portfolio. We dive into the intricacies of each company, meticulously examining their potential and risks. This aids us in constructing a resilient and promising portfolio.

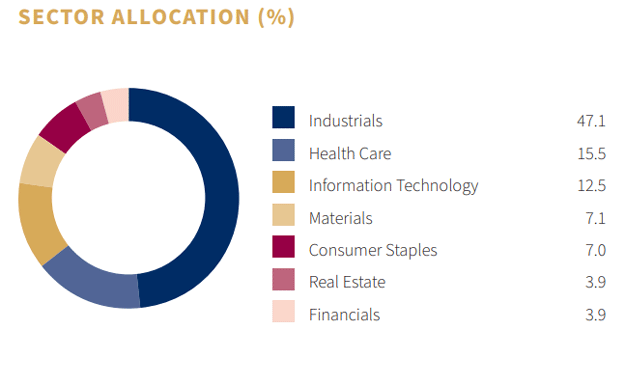

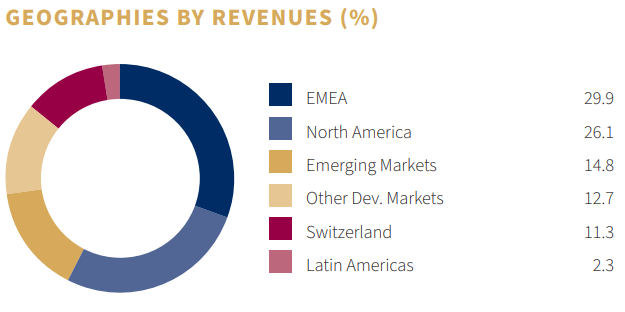

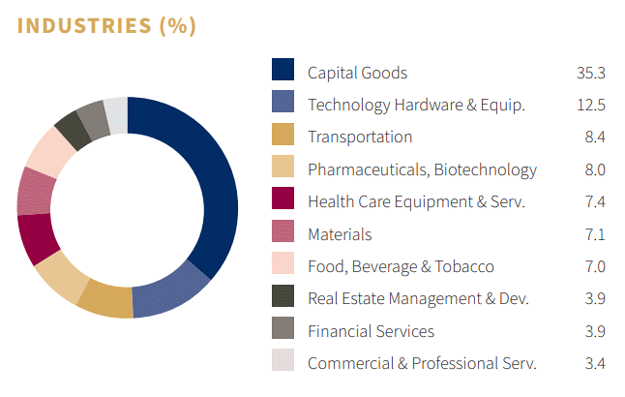

Diversification is key. Despite the focused approach, our portfolio is diversified across industries, business models, and geographic sales exposure. For instance, despite being invested in Swiss-domiciled companies only, less than 15% of overall revenue is generated from sales in Switzerland, making our portfolio global.

How do you identify high-quality businesses within the Swiss small and mid-cap landscape?

For us, high-quality businesses possess a competitive advantage also referred to as a Moat. They have robust business models that can cope with market shifts, demonstrating consistent profitability and resilience. We expect our companies to at least maintain their market position and often seize the opportunity of dislocations to gain further market share.

For instance, this happened during COVID-19 when some of our businesses took market share from competitors who were suffering much more from supply chain disruptions. Our businesses tend to exhibit traits such as technological innovation, strong brand presence, or unique market positioning. In other words, we simply want the best!

How does your investment approach integrate Environmental, Social, and Governance (ESG) principles?

As long-term investors in high-quality companies, ESG has always been ingrained in our thinking albeit it was not previously explicitly named.

We aim to invest in outstanding businesses that will be around and prospering in ten years from now. Therefore, these businesses have to do good by all their stakeholders - customers, suppliers, employees, owners, communities, society, and the environment. We believe that being continuously successful is otherwise not possible.

Hence, ESG considerations are integral to our investment philosophy. We follow a stringent set of exclusion principles that guide our investment decisions within the Swiss Small and Mid-Cap Equities. We prioritize investments in companies that align with our values and respect fundamental humanitarian, environmental, and ethical principles.

Could you shed light on the extensive research involved in your investment process?

Research is at the core of our investment decisions. We conduct in-depth qualitative assessments covering various aspects such as industry dynamics, value chain intricacies, business model robustness, and management quality.

This qualitative assessment integrates seamlessly with our quantitative analysis. We meticulously evaluate key operating metrics, pricing power dynamics, and cash generation capabilities over a full cycle. This helps us determine intrinsic value and forward earnings.

How does your team structure support your investment strategy?

Our team consists of two portfolio managers, supported by four financial analysts, and two risk managers. This collaborative structure enables comprehensive research, analysis, and risk management, enriching our investment decisions.

Being part of the Rothschild & Co Group also grants us access to extensive resources and a vast network. This affiliation enhances our capabilities, allowing us to leverage the Group’s expertise and insights.

Important information This document is confidential and produced by Rothschild & Co Bank AG (“Rothschild & Co”) for information and marketing purposes only and for the sole use of the recipient (“you” or “Recipient”). Save as specifically agreed in writing with Rothschild & Co, this document must not be copied, reproduced, distributed or passed, in whole or part, to any other person. This document does not constitute a personal recommendation or an offer or invitation to buy or sell securities or any other banking or investment product or to enter into transactions of any kind. Nothing in this document constitutes legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to an individual’s circumstances. The information in this document therefore neither takes into account the specific or future investment goals nor the tax or financial situation or individual needs of the Recipient. Interested persons should consult a qualified expert before making investment decisions. The value of investments, and the income from them, may fall as well as rise, and you may not recover the amount of your original investment. Past performance should not be taken as a guide to future performance. Investing for return involves the acceptance of risk: performance aspirations are not and cannot be guaranteed. Forward-looking statements, e.g. statements including terms like “believe”, “assume”, “expect” or similar expressions are subject to known and unknown risks, uncertainties and other factors which may result in a substantial divergence between the actual results, financial situation, development or performance of the issuer or the instrument and those explicitly or implicitly presumed in these statements, if any. Against the background of these uncertainties you should not rely on forward-looking statements. Rothschild & Co assumes no responsibility to update forward-looking statements or to adapt them to future events or developments. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. Income may be produced at the expense of capital returns. The preservation of the invested capital cannot be guaranteed. The performance data do not take account of the commissions and costs incurred on the issue and redemption of units. Should a client of Rothschild & Co change his/her outlook concerning his/her investment objectives and/ or his/her risk and return tolerance(s), he/she shall contact his/her Rothschild & Co client adviser. Additional information can also be obtained from the brochure “Risks Involved in Trading Financial Instruments” issued by the Swiss Bankers Association (www.swissbanking.ch/en/downloads). Although the information and data herein are obtained from sources believed to be reliable, no representation or warranty, expressed or implied, is or will be made and, save in the case of fraud, no responsibility or liability is or will be accepted by Rothschild & Co concerning this document, e.g. in relation to the fairness, accuracy or completeness of it or the information forming the basis of it or for any reliance placed on it by any person whatsoever. In particular, no representation or warranty is given as to the achievement or reasonableness of any future projections, targets, estimates or forecasts contained in this document. Rothschild & Co excludes all liability for losses or damages of any kind (both direct and indirect as well as consequential damages), which arise from the use of this document. The contents of this document may be changed at any time due to changed circumstances, whereby Rothschild & Co is under no obligation to update once published information. This document is distributed by Rothschild & Co in Switzerland and abroad to the extend allowed. Law or other regulation may restrict the distribution of this document in certain jurisdictions. The contents of this document are not directed or meant for persons subject to a jurisdiction that prohibits the distribution of this document or the investment funds referred to therein. Accordingly, the Recipient of this document must inform him/herself about any possible restrictions and comply with all applicable legal and regulatory requirements. For the avoidance of doubt, neither this document nor any copy thereof may be sent to or taken into the United States or distributed in the United States or to a US person (including but not limited to US citizens and US residents). Rothschild & Co Bank AG has its registered office at Zollikerstrasse 181 in 8008 Zurich, Switzerland, and is authorised and regulated by the Swiss Financial Market Supervisory Authority FINMA which has its office at Laupenstrasse 27 in 3003 Bern, Switzerland (www.finma.ch)