The marketing fanfare coming from Swiss banks would make it seem that they have already made the leap forward into the digital age. A new test shows that the digitized bank is to a large extent still an illusion.

The digitization of processes and client interfaces is part of the strategic planning of virtually every financial institution. Banks in particular are striving to pick up clients who have already been mobile and digital for years, by offering them account opening and banking services without direct contact.

At the same time, the banks are communicating the slightest new development in this area, whether it is a new-look website, a new app, simplified account opening over video identification, or digital advice services.

Simple Test

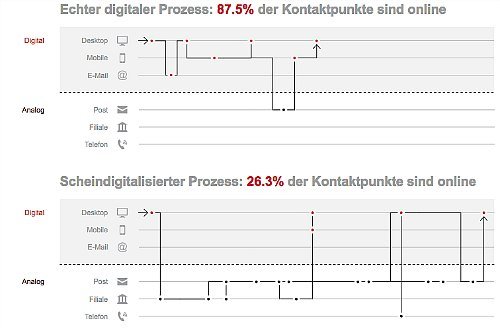

However, the reality of banking practise is to a large extent unchanged. The online marketing company Namics has dubbed this phony digitization, after carrying out a test of 14 well-known banks in Switzerland and Germany. Namics checked the so-called onboarding process, the opening of bank accounts and credit card applications.

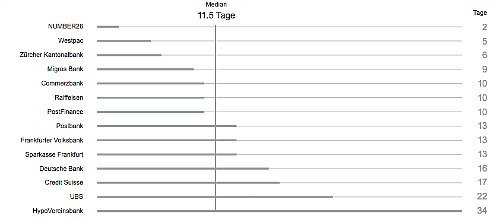

In the test, Namics did not rely on any digital hocus pocus, they simply checked how it was possible to become an online customer of a bank, using the mystery shopping technique. In Switzerland, they approached Credit Suisse, Migros Bank, Postfinance, Raiffeisen, UBS and Zuercher Kantonalbank. In Germany, Namics tested the online processes of Commerzbank, Deutsche Bank, Frankfurter Volksbank, HypoVereinsbank, Postbank and Sparkasse Frankfurt. Namics also looked at the services of digital challengers to traditional banks, Number26 in Germany and Australian Westpac.

Offline, Phone, Paper

Disillusionment was the order of the day: «The client mostly goes through existing offline processes. In the majority of banks, the client ends up having to present themselves at a branch despite attempting the online approach. Communication mostly happens by post. After paper, the telephone is the most used communication channel. »

Namics does not name any of the banks in its survey, but in one case 74 per cent of the contact with the client did not take place in the digital world. The non-traditional challengers on the other hand offered a genuine online banking experience.

Up to Four Branch Visits

Yet another «digital» nugget: In nine of the 14 banks at least one visit to a branch was necessary; in one case the client had to appear at the branch in person four times. On average nine letters were involved in the account opening package, online access and credit cards. The client had to make three phone calls before everything worked.

In one case it took 50 days before the client could use the new credit card.

Testing Banks – On Clients

Namics identified a whole series of mistakes, omissions and also fundamental lack of understanding towards the needs of digital clients.

In this study Namics confirmed that the banks are testing their attempts at digitization directly with clients. The result is that the user has to put up with numerous mistakes and corrections of processes. The usability of the bank’s online channel indicates significant problems. The processes are much too slow, sometimes taking weeks, while the client is left in the dark.

No Enjoyment

The client was not able to carry out the onboarding process either through the desired channel or on the channel offered by the bank.

Overall, the process took too long, the banks’ communication was unclear, and the contact was impersonal. In short, the client experienced the whole process as «disagreeable» and «unattractive». There was no enjoyment involved.