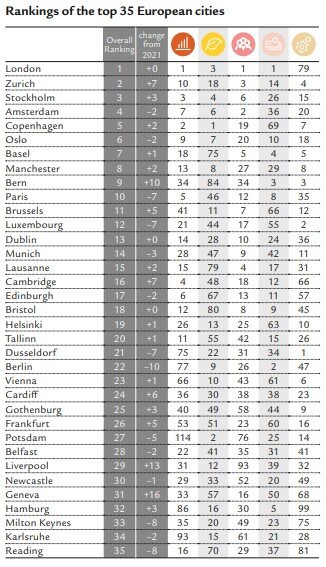

Led by Zurich, the Swiss metropolis climbed in the rankings of European cities as the most desirable for real estate investment.

Lagging only London, Zurich was second overall in a ranking measuring five core structural themes making up a city's real estate market, according to the European Thematic Cities Index (TCI) from Swiss Life Asset Management published Wednesday.

Six Swiss cities remained in the top 50 and each gained in the rankings, with Geneva registering the biggest gain, up 16 places to move into 31st overall, while Zurich climbed 7 places to number two.

The factors used to determine the rankings are a city's dynamism, healthiness, networks, cosmopolitanism, and accessibility.

«Zurich owes its increase to the second place to higher dynamism and accessibility rankings. It is a well-connected city and has an economically sound foundation which promises stability, but reduced growth potential,» the report said.

Basel and Bern

Two other Swiss cities made it into the top 10 rankings overall, with Basel increasing one spot to 7th place overall and joined by the capital city Bern to 9th place, gaining 10 positions from 2021.

Basel's gain came as the result of higher dynamism, networks, and accessibility rankings while taking a hit on healthiness placement. It is attractive to start-ups and has high-quality public amenities.

Bern's entry into the top ten came due to higher dynamism and network scores and is very commuter-friendly while providing ample green space to its residents. However, above-average car ownership reduced its healthiness score.

Financial Centers

Among financial centers, Paris dropped seven positions but remained in the top ten, falling to 10th place overall. Frankfurt gained five spots to rank 26th overall. Amsterdam was also in the top ten, although it dropped two places to 4th overall.

As with many other surveys, Scandinavian countries also ranked highly and scored in the top ten with Stockholm 3rd (+3), Copenhagen 5th (+2), and Oslo 6th (-2).

The TCI is designed for investors to be able to allocate capital in the real estate sector of «thematically strong» cities based on unique investment strategies. By way of example, an environmental sustainability-focused fund can pick cities in the TCI with strong ecological credentials by giving a higher weight to city healthiness.

The Top 35

(Source: Swiss Life Asset Management European Thematic Cities Index 2022)