Hundreds of small Swiss financial firms run the danger of losing their license by year end. Yet they don't want to lose their independence. Something has to give.

Swiss banking regulator Finma has stopped begging. Independent asset managers that do not comply with the new licensing requirement by the end of the year will be reported and their names put on a warning list that states they are providing unauthorized services.

It is unclear if this ultimatum will have any impact. According to recent findings by the Finma, about 1,535 of a total of 2,500 independent asset managers are currently going through the necessary steps to become licensed by 2023. But, at the same time, 661 have indicated that they will not be sending an application.

The other 400 haven't told the Finma anything, which means that they face sanctions and fines if they are still active at the start of next year. At this point, they won't get approval given the application process takes six months on average.

No Sale

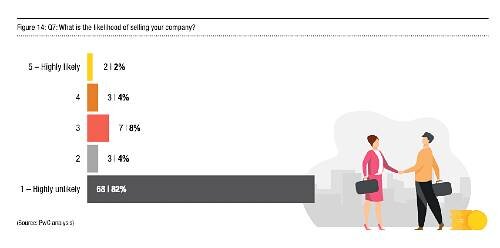

It is a picture of an industry sector in complete limbo, according to a Pricewaterhouse Coopers (PWC) survey of 83 independent asset managers between May and June. At the time, many of them seemed to be willing to get a Finma license. Now they are not - even though a clear majority (82 percent) indicated it was highly unlikely they would sell their business either (horizontal bar graph below).

The survey's findings mean there won't be a quick consolidation of the sector, which is probably something that Finma would be willing to live with.

No Suitable Targets

There have been some deals, many of which finews.com has reported on. PWC talks about eight transactions to date. Jean-François Lagasse, the head of banking consulting at competitor Deloitte, counts 15. Publicly disclosed deals include the sale of Diem Client Partner, BHA Partner, Artorius Wealth Switzerland, Pentagram Wealth Management, Octogone, and Investarit, with Wergen & Partner and Fransad being bought out by management.

In contrast, it appears that many asset managers are more than willing to make acquisitions, according to the PWC survey. But the problem is there is no one to buy.

«There is a discrepancy here. Almost none of the independent asset managers want to sell but a large number of them want to enter a partnership, merge or make an acquisition,», says Christian Bataclan, Director Deals Financial Services at PWC Switzerland. That means it is a highly competitive market that lacks potential targets, which more than likely entails high valuations.

Compliance Cost Burden

Mergers, divestments, and partnerships could have a positive impact on costs and scale, which could be an incentive to form alliances considering that about two-thirds of those surveyed by PWC said that compliance costs and reporting requirements will pose the largest strategic challenges in the future.