According to a new ranking, Swiss retail banks have made progress in their digital offerings over the past year. The leading bank also scores well in the area of investment.

Digitization is high on the agenda in banking because it not only enables new services but also attracts customers and reduces costs.

The Lucerne University of Applied Sciences and Arts (HSLU) presents a new study (in German) on the topic of Swiss retail banks. The Institute for Financial Services Zug (IFZ), in collaboration with the banking think tank «E.foresight,» took a close look at the digital offerings.

Who is Ahead

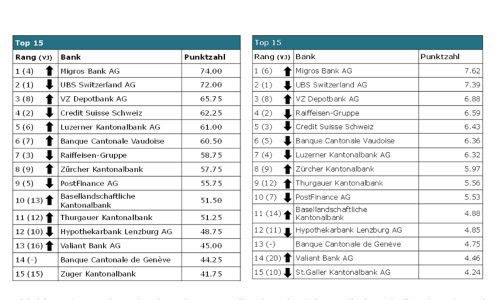

Migros Bank scored the most points in the ranking, displacing UBS from the top of the annual ranking which it held for two years.

Behind it, VZ Depotbank has worked its way up into the leading group, while larger rivals Credit Suisse and Raiffeisen Group slipped slightly. Postfinance has also fallen further in the rankings.

The lists were calculated using two methods. The first is an unweighted measure in which the mere presence of the total of 103 requested functions earned one point each. With a weighted method, functions were assigned varying degrees of importance

(Weighted and unweighted rankings of the most digital retail banks in Switzerland source: HSLU)

Considerable Potential for Improvement

Compared to last year's survey, 28 of the 41 banks surveyed have improved, according to the report. A particularly large amount has been invested in accounts, cards, and payments while allocating the fewest resources into financing.

There are still considerable differences between the retail banks and a great need to catch up in terms of functions, they continue. The coverage of functions ranges from 16 to 74 functions. 23 of the 41 banks surveyed offer less than half the functions of Migros Bank, leaving considerable room for improvement.