UBS’s forced takeover of Credit Suisse has cleared its next formal hurdle. The merger of the next organizational level after the holding companies has now been approved, and a timetable proposed for the Swiss entities.

The respective boards of directors of UBS and Credit Suisse have now also approved the takeover, according to a media release published on Thursday. Following the approvals, the formal merger agreement has now also been finalized. The merger is expected to be completed in 2024, subject to regulatory approval.

Form Filed With U.S. Securities and Exchange Commission (SEC)

UBS has filed a corresponding Form 6-K with the U.S. SEC containing unaudited pro forma condensed and combined financial information relating to the merger. These forms, which are also published by the SEC, became a key source of information for stakeholders of both banks immediately after the Credit Suisse takeover last March.

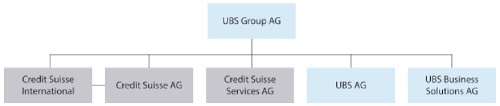

The formal merger of UBS AG and Credit Suisse AG takes place almost exactly six months after the two holding companies UBS Group and Credit Suisse Group were combined on 12 June (see chart below), when the assurances that UBS as the buyer had given and received at the time of the emergency rescue in March were finally contractually defined.

(Chart: UBS / SEC-Filings)

Ambitious Timetable

UBS is now preparing for the merger of the Swiss entities UBS Switzerland and Credit Suisse (Switzerland), also in 2024. UBS did not take the decision to fully integrate CS’s Swiss business until last August, resulting in a further delay.

The timetable for integrating the operating business has since remained unchanged, with the Credit Suisse brand set to disappear by 2025. The overall integration is due to be completed in 2026.