Share prices have recovered from the lows of the financial crisis in every sector of the Swiss economy. The exception: banks. Thomas Steinemann explains why in his essay for finews.first.

finews.first is a forum for renowned authors specialized on economic and financial topics. The texts are published in both German and English. The publishers of finews.com are responsible for the selection.

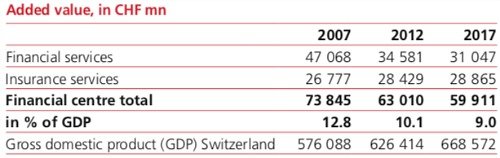

The Swiss Federal Department of Finance once a year publishes a study about the Swiss financial market, which considers the development of banks, insurers and pension provision funds. The value created by banks (see Financial services) and insurers is listed in the table below, starting in 2007.

It becomes apparent just how weak the performance of the banking industry has been. The value created by banks has dropped by a third since the financial crisis even as the Swiss economy as a whole expanded from 576 billion Swiss francs ($574 billion) to 668 billion francs over the same period. Insurers by contrast have been able to increase their value creation.

«The contribution of these banks to the Swiss gross domestic product was minute»

The sobering performance of the banks has nothing to do with a decline in the number of banks (from 330 to 253 within ten years). What happened was a decline in the number of foreign-owned banks and their branches. The contribution of these banks to the Swiss gross domestic product was minute. Hence, the value generated by the other banks, in other words the big banks, declined massively.

It is clear from the development of their profits: while Credit Suisse in 2007 had a profit of 7.7 billion francs, the bank posted a loss of 1 billion in 2017. Over at UBS, the trend at least was the opposite: while it had a loss of 20 billion francs at the time of the bailout, it generated a profit of 1 billion francs last year.

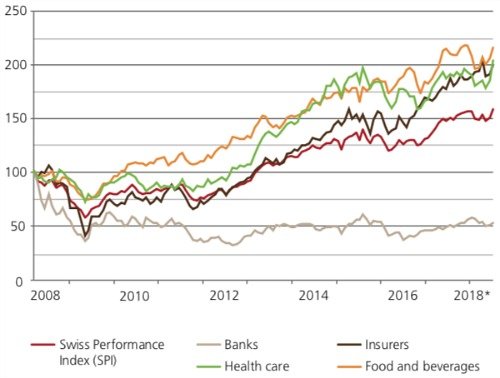

The share prices of the banks was in sync with the unfortunate development of their profits (see table below).

Banking is the only industry where share prices haven’t made any progress since the financial crisis and where shares still trade far below the records reached before the crisis. In the table above, it is not only the difference to other industries that stands out, but also the difference between banks and insurers.

The conclusion for investors: it is surprising that investors aren’t vehemently demanding a solid and sustainable business performance coupled with a steady growth of profit. While this isn’t the case, (big) banks may be good for (many) employees, but not for investors.

Thomas Steinemann has been chief investment officer and a member of the executive board of Privatbank Bellerive in Zurich since February 2013. After obtaining a degree in economics from the University of Zurich he started his career in the economic department of Zürcher Kantonalbank. During this time, he earned his PhD with a critical analysis of the European Monetary Union. He also worked for Credit Suisse for eight years and was chief strategist at Vontobel for another twelve years.

Previous contributions: Rudi Bogni, Peter Kurer, Oliver Berger, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Peter Hody, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Andreas Britt, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Peter Hody, Albert Steck, Andreas Britt, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Peter Hody, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Didier Saint-Georges, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Beat Wittmann, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, Claudia Kraaz, James Syme, Peter Hody, Dennis Larsen, Bernd Kramer, Ralph Ebert, Marionna Wegenstein, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Claudia Kraaz, Will Ballard, Michael Bornhäusser, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Michel Longhini, Anne Richards, Michael Welti, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Michel Longhini, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Claude Baumann, Markus Winkler and Konrad Hummler.