Investors reaped huge profits from Alibaba, Tencent and other Asian tech giants this year. Now, other values are coming into focus, James Syne writes in an essay for finews.first.

finews.first is a forum for renowned authors specialized on economic and financial topics. The texts are published in both German and English. The publishers of finews.com are responsible for the selection.

Over the long run, emerging market equities have delivered a total return of about 11.3 percent per annum in dollar terms, since the MSCI Emerging Markets Total Return index came into existence in 1988. This compares to an 8 percent annualized total return for developed market equities, based upon the MSCI World Total Return Index over the same time period).

For the year-to-date to 30 November, the MSCI Emerging Markets Total Return Index has returned 36.3 percent, far outstripping its long-term returns. More significant, though, is the make-up of those returns. The median stock in the index has returned only 21.6 percent, while 49 index constituents have returned more than 100 percent year-to-date.

Of the 49 stocks to have more than doubled, 22 are in the information technology space, including Chinese internet heavyweights Tencent and Alibaba. Other mega-cap Asian technology names have also performed very strongly: Samsung Electronics +58.0 percent, Taiwan Semiconductor Manufacturing Company, or TSMC, +41.6 percent. Naspers, a South African holding company with a 33.2 percent stake in Tencent, +76.5 percent.

«Cloud and payments have beaten analysts’ expectations»

Even with strong underlying growth in these companies, we feel it is paramount as investors to maintain valuation discipline at all times. We do not intend to cover all our research on these stocks in this investor letter, but would like to provide an update.

We feel that the Tencent business model is one of the strongest in the world. Whilst its total addressable market is smaller than Facebook’s, its core business continues to grow revenues successfully without overly relying on advertising. Cloud and payments have beaten analysts’ expectations, while the cost pressures in the video business seem to be abating.

Against this, though, is the degree to which the share price has out-run earnings. Tencent is valued at 37.6x 2018 consensus earnings, which is near the 40x earnings which has historically formed the upper limit to the stock’s valuation range. Even modelling for significant success in cloud, payment and video, we find it difficult to see great upside from here and do not hold Tencent directly.

«We see Naspers as undervalued, with an exciting portfolio of assets other than Tencent»

Rather, we hold a significant position in Naspers. Naspers trades at a deep discount to its underlying net asset value – in fact, Naspers trades at a discount to its stake in Tencent alone. We see Naspers as undervalued, with an exciting portfolio of assets other than Tencent, as well as a cheap and defensive way to have exposure to Tencent. We retain a significant position in Naspers.

Alibaba is a stock which has delivered very strong results in the last two quarters, both from monetisation of the Chinese user base, and also growth in the international business. Again, this seems to have been significantly valued in by the recent share price rise, and we find limited value above the $180 per share level (we initially bought Alibaba at $64 about two years ago). We have been reducing the position into strength and are now significantly underweight relative to the index weight.

«Large index constituents delivering strong returns can be challenging for portfolio managers»

Similarly, in the semiconductor space, we find TSMC challenging at above 15x forward earnings and have been reducing into strength. There is no denying the company’s edge in its sub-20nm products for high-performance chips, nor the strong return on capital seen in the last four quarters of results, but even pricing this in, we find reduced upside and prefer to allocate capital elsewhere.

In contrast, and as previously detailed, we find the low valuation, strong operational performance and improved corporate governance at Samsung Electronics highly attractive and retain a substantial investment in the stock.

Large index constituents delivering strong returns can be challenging for portfolio managers. We have enjoyed strong returns from mega-cap Asian technology stocks, but our valuation process is now causing us to increasingly differentiate between them.

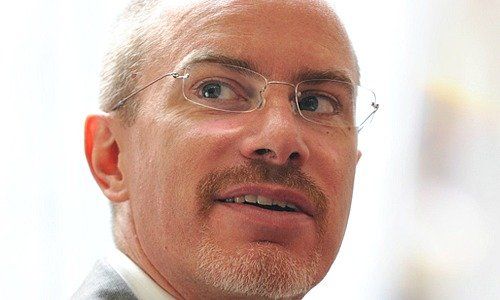

James Syme is a Senior Fund Manager at J O Hambro Capital Management Limited. He joined the firm in May 2011 and is responsible for global emerging markets opportunities strategy. He attended Cambridge University where he studied geography. He started his career as an analyst with H. Clarkson & Co and joined Henderson Investors in 1994, later he joined Societe Generale Asset and Baring Asset Mangement in 2006. He holds an Investment Management Certificate and is a Chartered Financial Analyst.

Previous contributions: Rudi Bogni, Peter Kurer, Oliver Berger, Rolf Banz, Dieter Ruloff, Samuel Gerber, Werner Vogt, Walter Wittmann, Alfred Mettler, Peter Hody, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Andreas Britt, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Peter Hody, Albert Steck, Andreas Britt, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Peter Hody, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Claude Baumann, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Didier Saint-Georges, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Beat Wittmann, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Michel Longhini, Frederic Papp, and Claudia Kraaz.