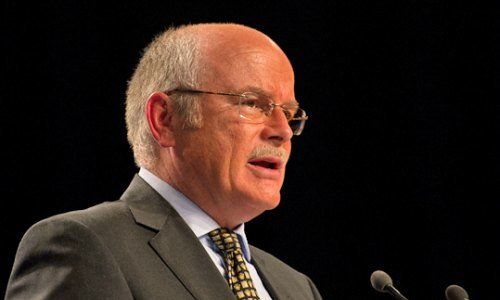

Credit Suisse chairman Urs Rohner is facing a shareholder revolt over bonuses. One of his board colleagues is linked to a pattern of corporate generosity within clubby Swiss business circles.

Shareholder groups and proxy advisers have stiffened their resolve to fight Credit Suisse on the Swiss bank’s pay policies. After concessions quickly made ten days ago to avert an embarrassing rejection, these still include a 3.2 million Swiss franc payday for long-standing chairman Urs Rohner as well as 10.24 million francs for Chief Executive Tidjane Thiam.

Besides Rohner, who has presided over years of rich payouts for himself and top executives, the uproar has engulfed a little-known member of Credit Suisse’s board: Andreas Koopmann.

The little-known Valais native used to run machinery maker Bobst, and has long been part of cozy Swiss business circles. Koopmann joined Credit Suisse’s board eight years ago, where he sits on the bank’s pay committee. He has been part of food giant Nestle's board since 2003 and presided the board of industrial firm Georg Fischer for the past four years.

Shareholder Rout

It is at Fischer that Koopmann got a warning shot of shareholder discontent: Georg Fischer’s shareholders rejected the firm’s compensation report last week – at the urging of U.S. shareholder advisers Institutional Shareholder Services, or ISS, and Glass Lewis.

Koopmann’s rout by shareholders at the mid-cap industrial stalwart is noteworthy because it is the same backlash against corporate generosity that now threatens far larger Credit Suisse. The 66-year-old executive, along with Harvard professor Iris Bohnet and former Credit Suisse investment banker Kai Nargolwala, was part of the committee to vet the bank’s million-franc payouts which have sparked the pay furor.

The head of Credit Suisse’s compensation committee is Jean Lanier, a Frenchman and long-standing board member who formerly ran credit insurer Euler Hermes. Lanier will largely escape scrutiny over the pay policies, despite presiding over them, because he is retiring from Credit Suisse’s board this year.

Rejection Urged

The bank’s pay report was widely panned: ISS, Glass Lewis, Swiss-based Ethos Fund and Zrating are fighting it in a non-binding vote. The representatives have urged shareholders to still reject some or all of Credit Suisse’s specific pay items – and these votes are binding for the bank – even after the bank climbed down somewhat.

Koopmann’s pay defeat at Georg Fischer is also noteworthy because the 215-year-old firm epitomizes the solidity of Swiss industry: it is viewed as unassuming, grounded and locally-rooted, despite conducting its business largely outside of Switzerland. Fischer’s piping outfits Abu Dhabi’s airport and the world’s highest residential building, Mumbai’s World One Tower which is slated for completion next year.

It is supremely embarrassing for Georg Fischer – a pride of Swiss business – to suffer such an ignoble defeat at the hands of shareholders, and it is Koopmann’s failing.

Swiss Backbone

The engineer-turned-executive is a flag-bearer for the smaller firms which form the backbone of Swiss business: he worked for firms like Bruno Piatti and Motor-Columbus before climbing to the top of Bobst. As an overseer for Swiss business lobby Economiesuisse, member of Lausanne’s technical university EPFL’s advisory board, and other board mandates, he is a rare breed of impeccably connected Swiss businesspeople.

If Koopmann’s habit of corporate generosity is now hobbling Credit Suisse, the warning signs appeared far earlier.

When he became Georg Fischer’s chairman in 2013, Koopmann quickly helped himself to breathtaking 48 percent pay rise to 443,000 francs. Last year, it was up to 543,000 francs. Koopmann wasn’t selfish: Fischer Chief Executive Yves Serra also saw his pay jump, by two-thirds to 3 million francs.

The sums don’t raise eyebrows in banking, but they are eye-watering for Swiss industry – far removed from Schaffhausen-based Georg Fischer’s down-to-earth roots.

Detached Overseer of Pay

Koopmann also became aloof from the reality of his rank and file of international business at Nestle and Credit Suisse. He earned 641,000 francs as vice-president of the food and beverage giant where, like at Credit Suisse, he oversees executive pay policies.

Nestle drew criticism for paying its new Chief Executive Ulf Mark Schneider 13.2 million francs in his first year, a move which mirrored the 14 million francs that Credit Suisse paid to the French-Ivorian insurance executive Thiam simply for agreeing to move to the Swiss bank.

Buyouts of this sort aren’t unusual for high-profile executives, and are merely a footnote of the wider pay brouhaha, but they illustrate the mentality of a C-suite that has become accustomed to being handsomely rewarded without taking on any personal or career risk.

No Banking Experience

As head of Bobst, Koopmann was a discreet chief executive who stood up for shareholder and employee interests, leading the firm through a tumultuous period. He left the company in 2009 as part of a succession plan.

He subsequently joined the board of Credit Suisse at the same time as Rohner, who was first the bank’s chief lawyer before advancing to operating head.

If Rohner is blamed for neglecting strategy and allowing its capital to seriously deplete, the blame can also be squarely laid at Koopmann’s door. Like Rohner, he doesn’t have much banking experience, but after former CSFB investment banker Richard Thornburgh, the two are Credit Suisse’s longest-standing board representatives.

Warning Shots

Koopmann hasn’t garnered much criticism in the pay debate which has erupted: only Glass Lewis recommends that he, along with pay committee members Bohnet and Nargolwala, be ousted from the board.

After the Georg Fischer warning shot, Koopmann is likely to be appear thick-skinned at Credit Suisse’s shareholder meeting on Friday. The Swiss corporate veteran already faced opposition at Nestle’s investor meeting earlier this month: shareholder group Zrating recommended voting him out, arguing that 14 years are enough, and a trimmer board could cope without his expertise.