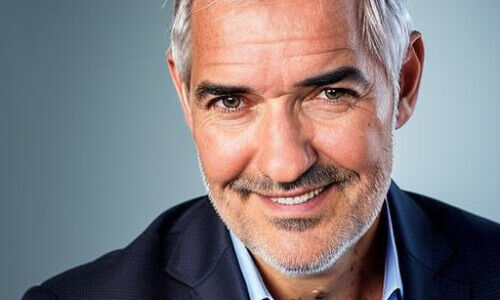

Leonteq CEO Jan Schoch's departure from the derivatives boutique he founded ten years ago paves the way for a new chapter. The task of tapping the Swiss firm's huge potential falls to a former Credit Suisse banker and advisor to Prince Charles.

Jan Schoch is out at Leonteq, a firm which is struggling with a crisis as it reaches its tenth year. While it may be tempting to criticize Schoch for overreaching, he and his partners remain the architects of one of the boldest Swiss finance firms in recent memory – even if the original vision is clashing with the limitations of reality.

That Schoch didn't recognize this in time is sure to gnaw at the entrepreneur for some time, though the CEO did mange to navigate his firm to third-quarter profitability before handing over the reins.

Ambitious Banker

The most important person in the new set-up is Christopher «Chris» Chambers, a Swiss-British citizen who is replacing Pierin Vincenz as chairman. Chambers is uniquely qualified to help squeeze more of Leonteq's promise out: the 56-year-old began his career as an investment banker before switching sides, joining Man Investments as Chief Executive in 2002.

That same year, Man bought Pfaeffikon-based hedge fund RMF for $833 million – the abbreviation of course stands for Rainer-Marc Frey, a Swiss alternative investment whiz kid who bought a 7.5 percent stake in Leonteq earlier this year. Frey's investment ultimately led the derivatives firm to reverse course, something which former major investor Gregor Greber had tried – and failed – to do with this vehicle, Veraison.

Radical Revamp

Frey's entrance led Leonteq's shares to surge: investors who bought the shares at around 25 Swiss francs earlier have seen the value of their stock nearly treble to roughly 65 francs per share. Unlike Greber, Frey has insisted on revamping under entirely new management – including Chambers.

He and Frey know each other from Man Group, but are tied through other interests as well, including Lonrho, an investment vehicle focused on Africa. Both of them sit on the board, along with Reto Sidler, an associate of Frey's from his follow-up to RMF, Horizon21, which was converted into a family office after the financial crisis of 2008-09. Others board members include Bruno Sidler, who ran logistics firm Panalpina for eight years, and Dieter Spaelti, the son of former Winterthur Insurance head Peter Spaelti who is also in the board of Ihag, the wealthy Buehrle and Anda family's private bank.

Advisor to Prince Charles

Chambers is known as approachable and open to new ideas – ideal prerequisites to turn around embattled Leonteq. His stellar network includes Prince Charles, who takes finanical and charitable advice from the former Credit Suisse banker. Leonteq is by far Chambers' biggest most prominent role in Swiss finance, but he is no stranger to the industry: he was on the board of consumer finance firm Cembra Money Bank until this year, and is also on the board of Berenberg's Swiss bank and property firm SPS.

At the Swiss firm, Chambers faces the growing influence of big data and artificial intelligence in finance. The firm will have to address and integrate new concepts like factor models, smart beta strategies and systematic or quantitative approaches.

New CEO Eyed

If the nearly ten-year-old firm can master this, it could advance to a leading asset manager – provided it can unleash its know-how in Asia, the most substantial growth market in the world. Asia is home to firms which can help Leonteq scale up to address the huge market potential that beckons.

Against this backdrop, who Chambers and his board colleagues choose as CEO will be key – several factors indicate that it will be an executive with an asset management background.