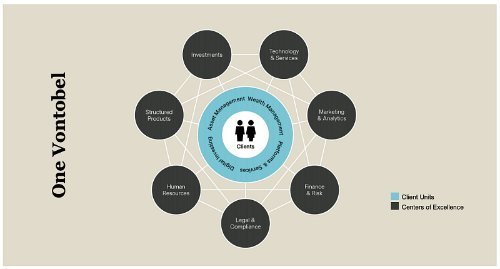

Vontobel is abandoning its divisions in a bid to sharpen its focus on clients. The move sparks major adjustments to its top management.

The Swiss bank is doing away with its three divisions – private banking, asset management, and investment banking – in favor of becoming an investment manager, it said in a statement on Monday. The move is a bid to put clients at the heart of its business, as well as to benefit from using technology to parse how clients pick and interact with their finance firms.

The move is an attempt to get in on the increasing need for investment solutions and personalized advice. Vontobel will group clients into three so-called centers of excellence.

The shift to investment expertise and buy-side business has massive implications for Vontobel's investment bank: the division will cease to exist in January, and its brokerage arm is being sold to Zuercher Kantonalbank. Roger Studer, the long-standing investment bank head, will exit top management and take a non-operational role as part of the reorganization.

A new technology and services unit will complement the Zurich lender's asset management and private banking arms. Felix Lenhard will oversee the tech arm, which will include Vontobel's flagship structured products arm.

Its Deritrade platform, by contrast, will move into a platforms and services center. This unit brings together services driven by technology, which are also intended for third-party sale. This will include Vontobel's business with independent asset managers, for example.

Targeting the Super-Rich

Vontobel's money management arm, led by Axel Schwarzer, and its wealth management activities under Georg Schubiger are reinforced by the move. The private bank will also target ultra-high net worth individuals in the future (the ardently-wooed segment is generally viewed as those holding more than $50 million in assets).

The bank's chief lawyer, Enrico Friz, will also join top management from next year. Vontobel hopes for more agility and faster growth from the move. The bank said it will attempt to flatten its hierarchy and establish and foster a cooperative working culture.

The top management of the new groups and units are as follows:

Client Groups:

Wealth management: Georg Schubiger

Asset management: Axel Schwarzer

Digital investing: Zeno Staub

Platforms and services: Zeno Staub

Centers of Excellence:

Technology services: Felix Lenhard

Investments: Axel Schwarzer

Structured products: Markus Pfister

Human resources: Caroline: Knoerri

Legal and compliance: Enrico Friz

Finance and risk: Martin Sieg

Marketing and analytics: Patrick Farinato