The coronavirus pandemic sent shoppers rushing to hoard toilet paper – but also scrambling physical gold.

If you passed through Bleicherweg, which leads off Zurich's main Paradeplatz banking square, in recent days, you would have noticed something unusual at number 41: lines of several dozen people were waiting to be let in at precious metal dealer Degussa.

One of the few places in Zurich to buy physical gold, Degussa's Zurich showroom is emblematic of the hoarding mentality prevalent with Swiss shoppers. While retailers were picked clean of staples like toilet paper, flour, milk, and eggs, Degussa was overrun by retail or affluent clients looking to buy an emergency ration of gold.

Access Capped

The German precious metals dealer saw demand spike in recent days, Andreas Habluetzel, CEO of Degussa Goldhandel, told finews.com. Daily volumes surged ten times over, he noted, without detailing numbers. With 12 branches in Germany and others in the U.K., Spain, and Switzerland, Degussa is Europe's largest gold dealer.

Degussa limited access to its showroom in Zurich to ten people – which resulted in a line snaking down Bleicherweg. The Swiss were buying gold bars, or legal tender Swiss gold coins colloquially known as «Vreneli».

Insurance Against Collapse

Degussa's clients spent an average of $5,400 on stockpiling physical gold, Habluetzel noted. «They aren't speculators,» said the ex-banker who opened the Zurich showroom eight years ago, «they are honorable people looking to ensure themselves and their families from a collapse in the financial system with real assets.»

The buyers are baking in the recent fall in the price of gold into their equation, he noted – because they are thinking long-term. Demand is strongest from independent asset managers who want to stow several kilos of physical gold in order to book it into their clients' portfolios, Habluetzel said.

Unswayed by Price Drop

On Tuesday, spot gold fell to trade north of $1,400 per ounce. Degussa's buyers aren't necessarily even taking the product home with them: the precious metals dealer maintains a downstairs safe with more than 3,700 deposit boxes. «Stowing assets completely outside the traditional finance system is interesting for many people,» Habluetzel noted.

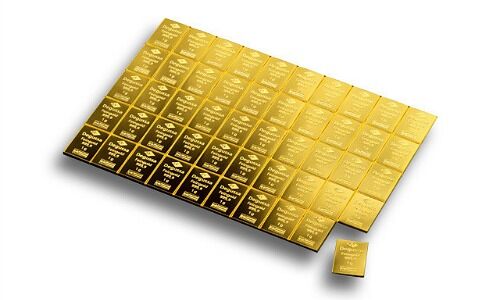

At the moment, nobody is selling and everyone wants to buy. So-called combibars (pictured above) are especially popular at the moment: credit card-sized plates of 50 grams of gold which – like a chocolate bar – can be broken off into one-gram pieces for payments.

Billionaire with Massive Reserves

Degussa belongs to Baron August von Finck, a secretive and controversial German billionaire who lives in a 15th-century chateau in eastern Switzerland. The 90-year-old built Degussa's business around his personal affinity for gold and other precious metals – and stowed massive reserves.

It isn't clear whether Degussa's business will slow as Switzerland hunkers down into a soft lock-down of schools and recreational businesses. The dealer is closing both the Zurich showroom as well as one in Geneva amid the shutdown. But as Habluetzel notes, «We have an online shop where clients can still place orders 24/7».