Swiss bankers felt little pressure on their pay last year – in fact, pockets like asset management stood out for high salaries.

In banking as in financial markets, there are winners and losers: in recent years, investment bankers have rarely been in the winning side – but asset managers have. This is apparent in a comparison of industry salaries regularly compiled by finews.com.

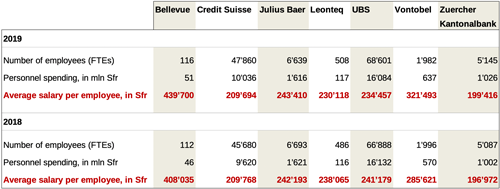

2019 mirrored previous years: Vontobel would have led as the top-paying firm again last year, when measured by average employee salary.

(UBS reports in Dollar)

The Swiss bank and asset manager was pipped by Bellevue Group, which was included in the comparison for the first time. A compilation of highest-paid executives revealed that the tiny asset manager pursues an «entrepreneurial» policy for compensation which paid out last year, as finews.com reported.

Double of Local Peer

Bellevue is also generous with its staff, where pay averaged 439,700 Swiss francs per year per employee, or $452,000. That is considerably more than Vontobel, which averaged 321,493 francs last year – and more than double of local state-backed lender Zuercher Kantonalbank, at 199,416 francs.

The duo Bellevue and Vontobel illustrate that asset managers and not bankers are sitting pretty in the Swiss financial services industry. Vontobel's wealth managers and investment bankers (the divisional structure was done away with this year) weighed the average lower. The bank's asset management alone reveals average pay for the unit's 434 staff of more than 465,000 francs annually.

Money Follows Returns

The reason lies, of course, with portfolio manager pay which is heavily tied to fund performance: stock-pickers should also paid handsomely for doing well by their clients. The more assets managed, the higher the potential for a share of the success – as in hedge funds. Favorable stock markets for most of 2019 underpinned the pay bonanza last year.

Ironically, asset managers have replaced investment bankers, which before the financial crisis were the kings (and less frequently queens) of compensation, thanks to risky bets and performance incentives. Regulators effectively abolished own-book trading through crushing capital rules – unsurprisingly, many «prop» traders moved into asset management.

Investment Bankers Thinned

At the lower end of the scale, Credit Suisse illustrates how investment banking pay has fallen: the Swiss giant's average pay for employee sank to 210,000 francs, from roughly 265,000 francs in 2011.

The drop is mainly due to pruning investment bankers in a restructuring led by ex-CEO Tidjane Thiam. The number of well-paid bankers in the securities and trading units thinned relative to the total number of Credit Suisse employees, leading to a dilution of average pay.