A widely-watched real estate index is poised to slip into frothiness in coming months – not just due to inflated property prices.

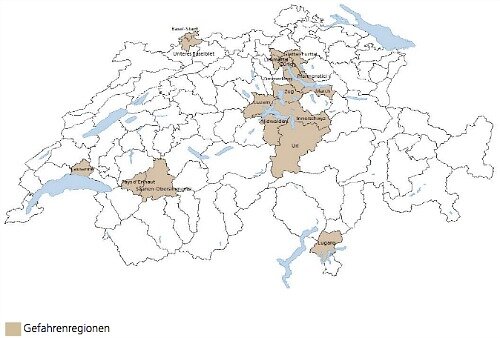

Swiss real estate prices will hit bubble territory in the third quarter, according to a quarterly Swiss real estate indicator released by UBS on Thursday (see graph). The surge is due income dropping amid the severe recession, combined with higher owner-occupied home prices, the Swiss bank said.

(Image: UBS)

Owner-occupied house prices climbed nearly four percent on the year, when adjusted for inflation, in the second quarter of 2020. This represents the strongest increase in seven years, while Swiss first-half growth collapsed at the sharpest rate in 40 years.

The wealth manager predicts trouble: high house prices aren't compatible with a persistent Swiss economic crisis, it said. «Continual price increases at current levels are not sustainable either in the face of falling incomes.»

Crisis Contributor

Are property prices in Switzerland up for a massive correction? UBS' experts voiced optimism that the imbalance will even back out by the end of next year (they also noted that the index can only measure past development).

Most indicators signal a drop in house prices – whether this is a momentary cooling of a prolonged period of frothiness in Switzerland's housing marketing or the beginning of a downward spiral remains to be seen.

Regional Hot Spots

For banks, the recession and falling house prices means a reduction in mortgage volume compared to 2019. While this means less revenue off home equity loans, it could also quietly contribute to a cooling of prices.

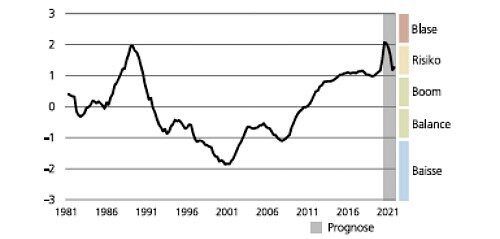

UBS' heat map illustrates the greatest imbalances in prices along Zurich's lakeshore, in Lausanne, and in Basel. The analysis measures local price to household income, rent levels, and appraisals on owner-occupied homes (see graph).

(Image: UBS, click to enlarge)