Swiss banks are pushing clients to buy their own products instead of promoting third-party assets. This is often to the detriment of the investor, a new study shows.

Retrocessions belong to the client, according to a landmark ruling passed by the highest court of Switzerland in 2012. It meant that the bank has to pass on the provision it receives from a third-party provider to the client who has bought the product.

The banks have reacted to the ruling by increasing the share of their own products in portfolios of their clients as well as by the raising their fees, according to a study published by VZ Vermoegenszentrum, a Swiss financial advisory firm.

Revenue-Booster

Since 2016, there has been a persistent and significant trend toward own-brand products, which by 2019 made up a third of client portfolios on average.

The trend makes sense from a bank’s point of view, said the study authors. Promoting and selling own-brand products to customers pays off in two ways as the client will pay both for having a deposit at the bank and for the products in the portfolio.

Conflict of Interest

The study claims that the promotion of own-brand products may however be to the detriment of clients, because the funds provided by banks often are lagging specialized best-of-class products. And yet the bank will naturally choose to sell its own product.

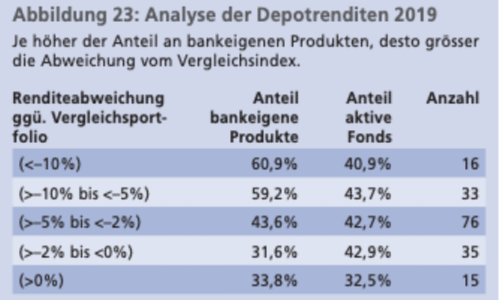

The return of a portfolio will suffer as a consequence. A portfolio with a higher share of own-brand products performed significantly worse than an average portfolio used for comparison reasons in 2019, said VZ.

It Pays Off to Compare

Out of 175 portfolios VZ had looked into in total, 16 that contained an average of 61 percent own-brand products performed 10 or more percent worse than the benchmark. 33 portfolios with 59 percent own-brand products performed 5 to 10 percent worse than the benchmark. And 76 portfolios with 44 percent own-brand products still performed 2 to 5 percent worse than the benchmark, according to the VZ study (see table below in German).