Swiss wealth managers benefited from frantic trading at the pandemic's outbreak. finews.com looks at what the dealing room boom did for clients.

Without exception, private banks mentioned the pandemonium in their dealing rooms during March and April. As the coronavirus snowballed into a pandemic, clients drove a trading boom.

Among the wealth managers to stand out with excellent first-half trading results were Julius Baer and Zuercher Kantonalbank (ZKB), where demand for structured products surged, or Lombard Odier and UBS' flagship wealth arm.

Higher Revenue Vs Fewer Assets

Bank Vontobel and Credit Suisse's main wealth unit fared less favorably, posting a fall in revenue. In times of renewed focus on clients in wealth management, metrics like revenue and profitability are perhaps less meaningful than performance on client portfolios.

What unites all the wealth managers is that all were hit by a drop in their assets due to the extreme market volatility in the first two quarters. How to reconcile broadly higher revenue because of increased client activity vs lower client assets?

Banks Put To The Test

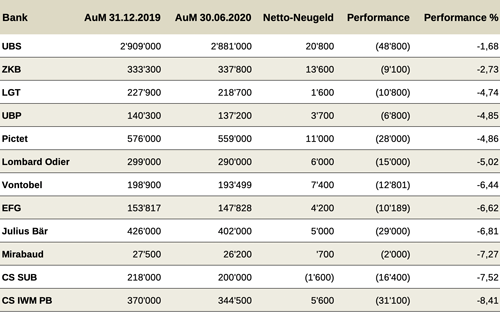

Based on assets under management and fresh inflows, finews.com looked at how well – or poorly – client portfolios did during the lucrative (for banks) corona boom.

The sample includes UBS' private bank, Credit Suisse's equivalent unit as well as its domestic bank, Julius Baer, Vontobel, EFG International, ZKB, LGT, Lombard Odier, Union Bancaire Privée (UBP), and Mirabaud.

Performance Ranking (in million Swiss francs or U.S. dollar)

With the softest drop in performance (-1.7 percent), UBS' global wealth department is the clear winner in the first six months. ZKB follows with -2.7 percent, while LGT ends in third place with -4.7 percent.

Credit Suisse's international private bank brings up the back with -8.4 percent. The Swiss unit didn't fare much better: clients booked in the domestic arm lost an average 7.5 percent on their portfolios in the first six months.

Six Beat The Benchmark

Measured against benchmarks Swiss Market Index and the MSCI World Index, which shed 5.4 percent and 6.1 percent, respectively, Vontobel, EFG, Julius Baer, Mirabaud, and Credit Suisse's performance was worse. Lombard Odier, Pictet, UBP, LGT, ZKB, and UBS beat the indies.

The differences in performance at the biggest wealth managers – and especially between giants UBS and Credit Suisse – is surprising. It also can't be explained with the skills of their respective portfolio managers alone.

Clients Pull Money

For one, some of the firms evaluated include institutional clients, with differing benchmarks depending on asset class, as well as portfolios exposed to more severe market ructions.

Client withdrawals also represent a weighty factor in the calculation; some of the wealth managers gave incomplete data on this (the privately-held ones aren't required to publicly disclose).

Delevering Portfolios

Clients' delevering of their portfolios also hit asset measures; Credit Suisse cited this as a reason for its lower managed assets. It is also worth noting that the majority of client portfolios aren't managed discretionarily.

That means that wealthy private clients at least in theory under an advisory model have the final say on transactions. Genevan wealth managers tend to have more of their clients' money in so-called discretionary mandates; UBS' share is now just over one-third of assets.

Hedging Can Backfire

Hedging represents another considerable factor: Geneva-based Mirabaud managed to hedge its discretionary mandates, which showed up in the form of less transaction fees. Performance can suffer from hedging if investors don't time their re-entry with markets reversing (the late-March turn surprised many investors).

Despite the often highly specific reasons for the varying shades of negative returns during corona, banks and their current infatuation with client focus, tailored investment solutions, individual client needs need to consider what services they are genuinely providing clients – especially when markets swerve and professional advice among wealth managers is as expensive as it is.