The first pandemic year illustrated which Swiss banks could benefit from financial market ructions – and which were hit. This translated directly to pay, as data compiled by finews.com illustrates.

Marked by the onset of the pandemic and teetering markets, 2020 was a boom year for financial services, and Switzerland's players rode the wave. A deeper look into results shows that some Swiss banks made use of the opportunities in trading and private banking better than others.

For example, UBS, Zuercher Kantonalbank, or ZKB, und Julius Baer. This contrasts with poorer results from Credit Suisse and Vontobel. This bled through to pay.

Highest-Paying Employer Unchanged

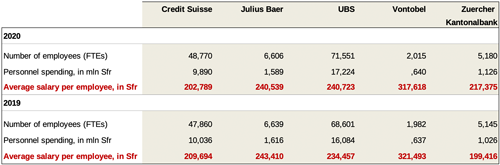

The average full-time employee salary fell markedly at Credit Suisse and Vontobel, according to a comparison by finews.com: by 7,000 Swiss ($7,800) at the former, and by nearly 4,000 francs at the latter.

Higher bonuses at UBS led to pay rising by an average 6,300 francs, while at ZKB the surge was a sharp 18,000 francs. This didn't change the ranking of highest average salary, which still belongs to Vontobel at 317,618 francs. UBS, at 240,723 francs average salary, and Julius Baer, with 240,539 francs, stand second and third place.

Dramatic Changes In 2020

(click on graph to enlarge)

Further down, Credit Suisse and ZKB traded places: the local government-backed lender pays its employees 217,375 francs per year on average. Zurich-based Credit Suisse stands at 202,789 francs per employee, continuing a years-long trend of lower pay. Five years ago, employees at Switzerland's second-largest bank earned 240,000 on average.

Landmark Mix At ZKB

The opposite is true at ZKB, where the average salary has risen by 34,000 francs per employee since 2015, when it stood at at 183,000 francs. The rise is due to higher bonuses and other variable compensation, the local lender said at its annual results earlier this month.

A much stronger diversification of revenue also factors: ZKB took in more in wealth management and investment banking than it did in its traditional bread and butter (interest income) for the first time in its history. The bank paid its employees a total of 46 million francs last year in «commemorative» additional bonuses to mark its 150th anniversary.

Philipp Rickenbacher's Imprint

At Julius Baer, a new trend emerged last year: both the wealth manager's overall headcount as well as the average pay per employee fell. Both developments carry the imprint of Philipp Rickenbacher, who took over 18 months and and quickly made strategic changes.

One is to effectively drop new new money as a target for the Swiss bank's 1,376 advisers, as finews.com reported five months ago. The new pay plan follows Rickenbacher’s pledge to focus on sustainable profitability, after ditching a target on money-gathering it held for years as part of a growth drive overseen by ex-CEO Boris Collardi.

Though the bonus changes don't begin taking effect until next year, 90 private bankers already left Julius Baer for greener pastures last year. The bank's current spending cuts will see it lay off 280 people this year.