The finance sector remains a key pillar of Swiss output – but not due to its banks. The big two in particular are losing in significance.

The trend has been apparent for several years now: finance's share in Switzerland's economic output is shrinking. While it stood at 10.1 percent in 2011 of gross domestic product in 2010, it fell to 9.7 percent last year, according to Swiss government data published this week.

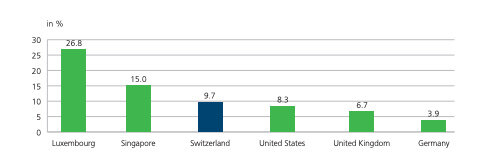

An international comparison show the concentration of banks and insurers remains high (see graph above). A closer look reveals that finance's contribution to Switzerland's GDP rose to 68.1 billion Swiss francs ($74.4 billion) last year, from 63.3 billion francs in 2010.

Banks Still Lead Insurers

The more than seven percent rise is due to the insurance industry, whose contribution rose to 32.6 billion francs from 25.9 billion francs over the decade. By contrast, banks are retreating. While the banking industry's share of GDP – 35.5 billion francs – still edges out insurance, it has slid by 2 billion since 2010.

During that period, the industry has grappled with landmark changes to their traditional bread and butter – cross-border wealth – by pressure on their profit margins due to low and negative interest rates, and by a series of foreign banks leaving Switzerland. Heavyweights UBS and Credit Suisse to Swiss growth are also no longer as significant to Swiss output.

Healthy Swiss Growth

Overall, Swiss GDP grew more than 11 percent over the same decade to 702.2 billion francs, against the backdrop of banks contracting. Economically speaking, Switzerland is better than its banks, while insurance has become the engine of financial GDP.

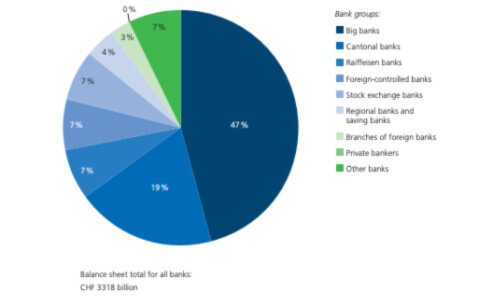

Swiss banks are as lopsided as ever: UBS and Credit Suisse account for nearly half of the entire balance sheet sum of the country's 246 lenders (see graph below).

The data also means less income for state coffers from corporate taxes, especially in areas dense with banks like Zurich, Geneva, Basel, and Lugano. Combined with income tax on employees of the financial services sector, the contribution rose by nearly one-fifth to 108.9 billion francs in 2018, the most recent data, compared to four years before.

Pitching In To State Coffers

However, the percentage of finance-related tax income from companies and individuals relative to overall dropped to 7.2 percent from more than ten percent over the same four-year period.

Banks' decline is more apparent here: their share of overall tax income fell to 1.5 percent in 2018, from 2.6 percent in 2014. Both UBS and Credit Suisse deferred taxes for several years, in the wake of the 2008/09 financial crisis.

The decline in significance of Switzerland is also apparent in cross-border interbank transactions over the last decade. By contrast, Swiss players are doing more interbank business domestically, illustrated by an increase in receivables between banks in Switzerland.