Investors who listen to their gut instinct are in the minority – but they are successful: emotional investors are more willing to take risks, generating higher returns in 2019 and digest crises better than rational investors. These are some of the findings of the LGT Private Banking Report.

By Eline Hauser, Marketing Manager, LGT

People often act based on emotions – even on the stock market. In contrast to their rational counterparts, they sometimes let their intuition, including feelings of doubt, uncertainty, greed or hope, guide them. Even if this type of investor is viewed skeptically by some, their approach can be quite successful, as the LGT Private Banking Report shows.

According to the study, emotional investors in Switzerland, Austria and Germany achieved an above-average return of roughly 15 percent (vs. the average of 10 percent) in 2019.

One reason for this may be that 55 percent of investors who tend to make their decisions on an emotional rather than rational basis also consider themselves more willing to take risks.

A Good Decision

They, therefore, invest more in riskier asset classes such as equities. In 2019, the proportion of equities held by emotional investors was 44 percent, compared with 32 percent for rational investors – and the larger the share of equities in the 2019 portfolio, the higher the returns generated. The emotional investors’ decision was therefore a good one.

Investors who designate themselves as emotional also have a higher share of actively managed funds than the peer group. This group of investors is, therefore, placing a strong focus on increasing returns and asset growth.

Among the investors who are pursuing asset growth, the proportion of emotional investors (14 percent) is significantly higher than among investors who are targeting asset preservation (7 percent).

A Severe Event

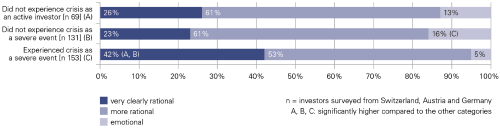

Thanks to their emotionality, these investors are also better able to cope with crises. In contrast, rational investors who experienced the 2008 financial crisis much more often perceived this as a severe event: a total of 42 percent of the investors who experienced the financial crisis as a severe event classify themselves as rational investors.

At the same time, a larger proportion of emotional investors, 16 percent, did not perceive the crisis as severe (see Figure 1 below).

Self-Assessment of Emotionality And Experience With Crises

(Very clearly rational investors, 42 percent, experienced the crisis as being a much more severe event than investors who are more rational, 53 percent, or emotional investors 5 percent.)

But why do emotional investors tend to remain more relaxed? «The correlation is not quite clear in this case,» says Prof. Dr. Teodoro D. Cocca, «on the one hand, the results may indicate that one’s own – possibly emotionally traumatic – immediate experience with the crisis has resulted in a less emotional (distanced) approach to financial markets. On the other hand, it could be those very rational investors in particular perceived the crisis as being especially severe, because their understanding of financial markets functioning rationally was severely shaken during the crisis.»

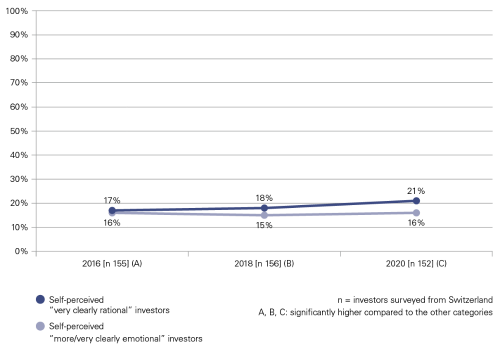

Emotional investors do not allow themselves to be unnerved by crises and remain true to their gut feeling: only 41 percent thereof say they will base their future investment decisions to a greater degree on facts, while the figure for rational investors is 70 percent (see Figure 2 below). However, the relative proportion of rationalists has not increased significantly since the financial crisis.

Change in Rationality – Proportion of Rational vs. Emotional Investors

(During the period assessed, the proportion of rational investors increased only very slightly, despite having experience with crises, while the proportion of emotional investors remained about the same.)

The Majority Remains Rational

Although emotional investors made a lot of money in 2019, there is only a small number of them. A country comparison between Switzerland, Austria and Germany shows that only 5 percent to 16 percent of investors categorize themselves as emotional investors. 2019 was also the first time that there were more men than women in this category (11 percent vs. 9 percent). Obviously, letting emotions run free when investing is not something that appeals to everyone.

As part of the LGT Private Banking Report, the Department of Asset Management at Johannes Kepler University in Linz, under the leadership of Prof. Dr. Teodoro D. Cocca, in January/February 2020 conducted the sixth survey since 2010 on the investment behavior of private banking clients in Germany, Austria and Switzerland. A total of 358 individuals were surveyed. The main criterion for participation in the survey was the disposable investment capital. In Germany and Austria, the minimum disposable investment capital was 500,000 euros and for Switzerland, it was 900,000 francs. Due to the effects of the corona pandemic on financial markets, a follow-up survey was conducted in April 2020 with the private banking clients in Switzerland who had already been surveyed in January by the LINK Institute.