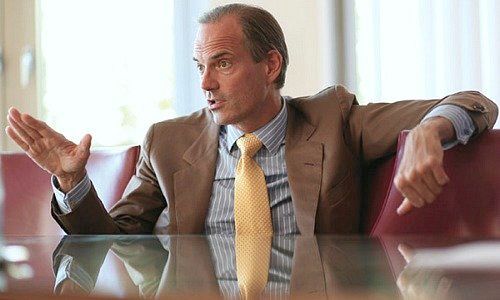

In the second part of his interview with finews.com, Syz Chief Executive Eric Syz explains that he would hand over responsibility at any time. And why the bank still hasn’t replaced him yet.

Eric Syz, you don’t only collect fine art, but banks too. In 2015 you acquired the Swiss private banking unit of Royal Bank of Canada (RBC). Are you still in the market for private banks?

We continuously are looking at takeover targets. But the situation has changed since our last acquisition. Banks have to make sure to an even greater extent that they don’t spread themselves too thinly. When they make an acquisition, this is often exactly what happens in a first step. Also, the targets still up for grabs are often hard to sell. There, the cleanup work would be too laborious.

How does Syz avoid being spread too thinly?

We concentrate on a few markets in Europe, Africa, Latin America and on Switzerland only. We don’t want to focus on more than 20 target markets. But instead we penetrate those at great depth. Essentially, foreign customers appreciate Switzerland as a safe haven.

«We haven't yet reached the pre-crisis level»

But we have to deliver the content. African clients are at least as demanding as European.

Acquisition are also costly – Syz only became profitable again in 2016. How are you doing currently?

We haven’t yet reached the pre-crisis level. But earnings and net new money are looking good. We are still working on removing former RBC assets that don’t fit in our core markets. Our long-term reputation is more important than short-term profits. In the end, it is my name on the door downstairs.

When you bought the RBC division, you set foot on U.S. soil. Will you expand further there?

We continue the SEC-licensed business with taxed U.S. assets and maintain an office in Miami. We currently are evaluating our long-term strategy.

Zurich’s Bank Vontobel has only just opened a branch in New York. Are you reluctant?

The growth is there. But it is worth weighing up opportunities and risks. Our new head of wealth management, Silvan Wyss, knows all about the dangers of the business as he used to be the operational head of Credit Suisse’ private bank in the U.S.

The recent expansion in Munich shows that Syz is focusing strongly on European markets, even though the EU is in crisis. Aren’t the risks even bigger there?

In Europe, it is all about a fundamental issue. As an asset manager, if you want to do business with institutional investors in EU countries, you forcibly need a local branch.

«Active managers act as guarantors against the discrimination on the capital markets»

Our latest branch is in Munich and the others are based in London, Luxembourg, France, Italy and Spain. In private banking, we can be more selective. We are present only in Italy even though this market is very competitive.

Syz explicitly has positioned itself as an active manager of assets. Given the success of passive products, won’t you rue this strategy?

Passive investments have come to be considered the only feasible alternative among institutional investors. If the passive market one day will exceed the active market in terms of volume, we would have reason to worry. This would put in question the fundamentals of the capital market, because passive funds only invest according to in- and outflowing assets. The valuations of assets still vary, but not because companies are being rewarded or punished for their business performance. The volatility increases enormously because of the herd instinct of index investors. Apart from the fact that active managers have a raison d’être in their own right, they also act as a guarantors against the discrimination on the capital markets.

You have appointed new heads of both wealth management and asset management in recent months. Was it necessary to bring in new people?

Absolutely. Fabian Dufresne, the predecessor of Silvan Wyss in wealth management, has overseen the doubling of the private banking volume over the past five years and the expansion into new markets. When he announced that he planned to retire, we passed responsibility for the division on to Silvan Wyss.

«I try to hire people who are at least as good as I am»

We have successfully developed Katia Coudray internally. This path is not necessarily the easier one. If someone ascends the career ladder, the question always is: where did they get their experience from?

You also have grown with Bank Syz. Do you put the same question to yourself?

I try to keep on learning and I’m also being coached. I try to hire people who are at least as good as I am. If somebody is able to do my job better than I am, he can have it.

So none of your employees has so far been better than you?

None has been as demanding and challenging in the business as I am! But I don’t want to hang around. I’m 60 now. One of my sons is in the business. The bank will decide who is to take over.

Eric Syz, 60, is the co-founder and CEO of Syz Group. In 1975, he joined Guyerzeller Bank as an apprentice, before moving to S.G. Warburg (today a unit of UBS) in London (from 1977 through 1979). From 1981 to 1984, Syz worked as an investment banker at Paine Webber (another UBS unit) on Wall Street. Subsequently, Syz returned to Switzerland and joined Lombard Odier, for which he worked from 1984 through 1995.

Together with Alfredo Piacentini and Paolo Luban, Syz launched Banque Syz & Co. in 1996. After a restructuring and the departure of partners, Syz is focusing on two business segments: private banking and asset management (Syz Asset Management). Syz Group has 500 employees worldwide and manages 36.3 billion Swiss francs (at the end of 2016).