Year-end league tables for investment banks show the fruits of Credit Suisse's three-year restructuring, while hometown rival UBS has dropped off. Why?

In banking, «to do a UBS» means to dramatically reduce investment banking activities which soak up capital, in favor of less-risky wealth management activities. Credit Suisse has followed its larger Swiss rival's path, set out in 2012, with its own three-year restructuring under Chief Executive Tidjane Thiam.

UBS' vision was to stay in the game in the activities it saw as relevant: investment bank boss Andrea Orcel is a renowned European financials dealmaker, and the bank wanted to return to its Warburg, mergers-and-acquisition merchant bank roots. UBS has also historically been a strong equities house, and never – like Credit Suisse or Deutsche Bank – a bond powerhouse.

Credit Suisse Leads – UBS...

Switzerland's largest bank has failed in that effort, according to Thomson Reuters investment banking league tables published by the «Financial Times».

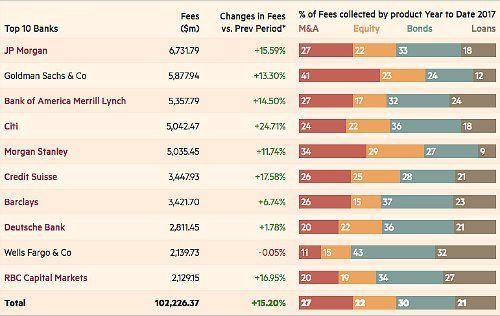

Total Revenue

Sobering for UBS: the bank is no longer a top-ten investment bank according to revenue. By contrast, Credit Suisse is the strongest non-American bank behind the most powerful five U.S. investment banks. 2017 was a bumper year for Credit Suisse: the bank's growth in stocks and bonds outpaced the wider market's 15 percent rise. Credit Suisse's rude health last year comes from equities of all places – UBS' traditional stomping ground.

Revenue Equities

Securities firms saw a boom in equities last year: revenue from capital hikes, stock issues and initial public offerings climbed 43 percent. For UBS, equities is the only investment banking discipline where it still competes: the bank's revenue surged by 61 percent, meaning it won market share off rivals. The fly in the ointment for UBS? It was outpaced by Credit Suisse's $227 million in revenue.

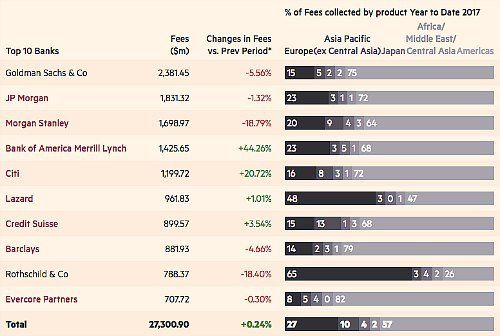

Revenue M&A

And what of UBS's prowess in mergers and acquisitions? 2017 was a ropy year for M&A, illustrated by league tabler leader Goldman Sachs' fall in revenue. Credit Suisse, which has advised on major deals like Bayer's $66 billion takeover of rival Monsanto, eked out a 3.5 percent revenue rise.

UBS doesn't appear in the top-ten, though Orcel reinforced management in Europe late last year. The league tables suggest that Credit Suisse «did a UBS» more nimbly and profitably than the larger rival itself did. Unlike Deutsche Bank, Thiam can stake his claim in global investment banking.

No Chasing Volume

To be sure, UBS stopped chasing league table volume when Sergio Ermotti embarked on the 2012 revamp, which initally predicted the bank would shed 10,000 fixed income staff. The bank's drop to the bottom ranks is down to its pledge to use its capital more sensibly, not subsidize trading with cheap money from elsewhere in the bank, and to pursue profitable and lucrative investment banking areas only.

A spokesman for UBS highlighted that the bank managed a 10 percent rise in revenue from advising on deals in the first three quarters of the year, while the overall pot shrank. The bank's fourth-quarter results are expected on January 22.