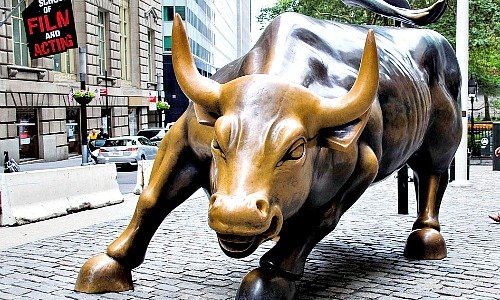

Recent stock market falls raise the specter of an end to the nine-year bull market – an ultimate test for Swiss banks. finews.com considers the reasons.

1. Clients Don't Bite

Private bankers have relatively easy pickings when stock markets are buoyant. But acquiring new clients when markets are falling takes more time – especially true of Europe's risk-shy clientele, if less so with potential clients in Asia's still trading-heavy financial centers. Overall, private bankers need more convincing arguments as well as crucially sensible investment products that produce return in bear markets (see point 3).

2. Naked When Tide Goes Out

If stock markets keep falling, the problem that banks have been grappling with since the financial crisis will come to the fore: they aren't winning enough fresh money from clients. The trend isn't new – a study last year said that Swiss private banks took in less net new money in 2016 than the year before. Until now, the banks have managed to keep bulking their overall assets – thanks to stock market gains.

Swiss banks managed more than 6.65 trillion Swiss francs at the end of 2016, according to the Swiss Bankers Association.

This effect will dissipate if the tide goes out on healthy markets, showing who has been swimming naked, in the unmistakable words of Warren Buffett: assets will drop. Banks rely on commissions linked to how much they manage, so a stock market drop weighing on their assets effectively means taking in less fees.

3. It's the Performance, Stupid

Until last year, investment bosses at private banks rode the wave of rising stock markets. It isn't too difficult to generate return for clients when the Dow Jones Industrial Average has more than tripled in the last nine years. By contrast, private banks will find it more difficult to generate that return in falling markets interspersed with spurts of volatility. At the same time, the turbulence presents a major opportunity for asset management to outdo its cheaper passive and exchange-hugging rivals.

- Page 1 of 3

- Next >>