The Swiss exchange operator's disposal of its payments arm to France's Worldline represents an early Christmas present for Swiss banks including UBS and Credit Suisse.

SIX Group's May sale of its payment services arm to French rival Worldline concluded this week. For the 130 members banks of the exchange operator, the move means a special dividend, it has emerged.

The disposal will result in a book gain of 2.7 billion Swiss francs for the Zurich-based financial utility – money that will flow into the coffers of its owners. Credit Suisse and UBS jointly own just over 30 percent of SIX.

Stake Worth More

Swiss bank Bellevue disclosed the total windfall late on Thursday. Bellevue holds 1.175 percent of SIX's stock, and said it was told of the disposal gain by the SIX. The bank in turn did the math and disclosed to its shareholders that it would accord a higher value to its SIX membership in its books.

For Bellevue, this means an improvement to 43.8 million Swiss francs ($44 million) from 23 million francs, after factoring in a discount for the stake's illiquid nature as well as residual taxes. This may change yet again, as SIX plans to update its accounting for the disposal in January.

Big Bank Windfall

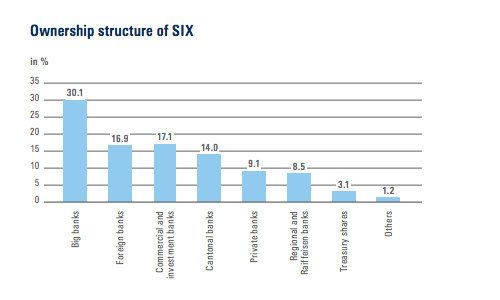

Informed opinions can be made about other banks' share from Bellevue's calculations. SIX's shareholder structure is, UBS and Credit Suisse's stake aside, somewhat opaque, according to the following diagram:

UBS and Credit Suisse, with 17 percent and 13 percent ownership of SIX, respectively, are in for the biggest windfalls. If the two apply the same factor to their SIX stake as Bellevue, UBS could book a 275 million franc gain and Credit Suisse a 225 million franc one.

To be clear: neither bank discloses the value of its SIX stake, so what potential upgrade the Worldline disposal will mean for them is a rough estimate at best. For Bellevue the gain is material: the bank said it the spoils would feed directly into shareholder's equity – a welcome boost in times of tougher capital requirements.