Central bankers are taking backstage in the current coronavirus crisis. Swiss top official Thomas Jordan is being praised for how he has handled the situation so far.

The Federal Reserve’s surprise cut of the leading interest rate to zero made markets jittery if anything: the cut in mid-March was followed by a massive drop in stock prices, which also pulled the stocks of Swiss financial services firms lower.

When the Fed later teamed up with the Swiss National Bank (SNB), the European Central Bank (ECB) and Bank of Japan to throw together a liquidity package, investors suddenly got reminded of the financial crisis in 2008 – it created new angst among traders.

The Role of the State

The current crisis is not a one that central banks can solve. The pandemic is affecting the health-care sector and the so-called real economy first and foremost. For observers such as Thomas Stucki, veteran investment chief of St. Galler Kantonalbank (SGKB), the crisis isn’t one that monetary policy instruments can cure.

Instead, the state will have to step in to prevent a huge number of firms from collapsing. Central banks meanwhile ought to keep to the background. They need to provide liquidity to maintain the stability, much like the SNB did in connection with the emergency measures taken by the government last week. Some central bankers have shown to be more adept at fulfilling the task than others.

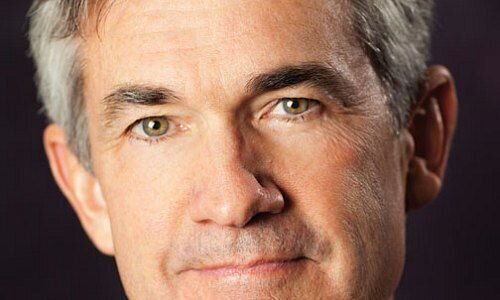

1. Thomas Jordan: Used to Criticism

The SNB is getting praise for the way in which it has handled the situation so far. The directorate, led by Thomas Jordan, is used to being criticized, having persisted with a negative interest rate for more than five years, which is tough on banks and tough on pension funds. For the moment, such criticism seems far away: «The SNB and Thomas Jordan are cutting a confident figure,» said Stucki in his report. «There’s no sense of hectic activity, but instead a well-considered approach.»

In Switzerland, the bank is making sure that the financial market has enough liquidity available, while fighting to prevent an appreciation of the franc through targeted currency market interventions. The bank is maintaining a flexible stance under pressure, offering to remove the anticyclical capital buffer for banks. And at the same time, the bank is giving evidence of its global importance through its participation in the global program to sustain liquidity.

2. Christine Lagade: Unguided Bazooka?

New ECB boss Christine Lagarde (pictured below) is getting distinctly lower marks for her first few weeks on the job. Stucki says that she hasn’t instilled a great sense of trust. She may have signed off on a 750 billion euro quantitative easing program, but it remained unclear how this money ought to be used.

And while the ECB chief at first was less than keen on helping finance the debt of Italy, which is the hardest hit country in the pandemic, she now has started campaigning for corona-bonds in a bid to help the southern European countries.

3. Jerome Powell: Back in Full Swing

Jerome Powell, president of the Federal Reserve (pictured below), has found back to his old form after the heady early days. It is the «whatever it takes» dogma that served the U.S. so well in overcoming the financial crisis. The Fed is buying fixed income at will, including the bonds emitted to finance the U.S. aid program. «The public appearances of Fed President Powell are full of the necessary composure and calm,» said Stucki.