The Swiss bank's latest partnership is reminiscent of a bancassurance strategy which flopped nearly two decades ago. finews.com on what's different this time.

Bancassurance is back: Credit Suisse is inking a digital partnership with Switzerland's largest non-life insurer, Axa, the two said in a statement on Wednesday. The two plan to sell the Paris-based insurer's products through the Swiss bank's new app, CSX, which is due to launch next week.

The tie-up, effective from the first quarter, is surprising – except that it isn't. Axa and Credit Suisse have a long corporate history together: the Swiss bank sold its Winterthur insurance unit to the French company in 2006 after a nine-year «bancassurance» bid foundered. Urs Rohner, Credit Suisse's outgoing chairman, has variously argued for a bancassurance 2.0 approach.

Drafting Board Idea

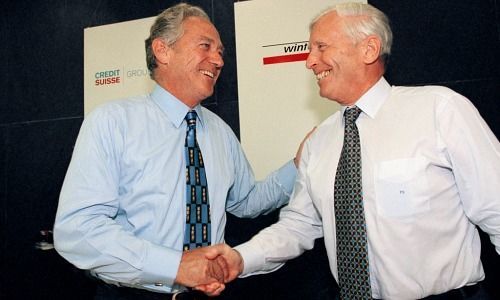

The most recent liaison between the two is surprising in that the last one ended in an expensive debacle: then-Credit Suisse Chairman Rainer Gut and Winterthur's boss, Peter Spaelti, merged the two under the Swiss bank's holding.

Shortly before the $9.51 billion deal, then CEO Lukas Muehlemann had memorably said for Credit Suisse, «why buy the cow when you can get the milk for free?». The disparity was telling: bancassurance looked good on the drafting board but was difficult to translate into real life – at least in Switzerland.

Banking and insurance turned out to be difficult to fuse, particularly in product distribution and sales: clients typically buy banking products frequently, but insurance policies less so. The flop hastened the departure of CEO Muehlemann in 2002; successor Oswald Gruebel finally offloaded Winterthur to Axa four years later for 7.9 billion euros ($9.3 billion).

Lack Of Client Interest?

Nearly 15 years later, Credit Suisse is mounting a «Winterthur reloaded» strategy. To be fair, much has changed in the intervening years: bancassurance is no longer as tied to two different cultures. Sales are increasingly shifting to online platforms where clients pick and choose what they want or need.

Ultimately, clients will decide the success of bancassurance's revival. Its last incarnation foundered for lack of market interest, and modern financial apps aren't immune to this. Clients decide quickly whether neo-finance providers are focusing on their needs – or whether they are being «pushed» products through newer, digital channels. If so, they are prone to swipe left and move on.