Swiss regional banks have proved particularly robust in recent years. But now pessimism is spreading, as a new industry survey shows.

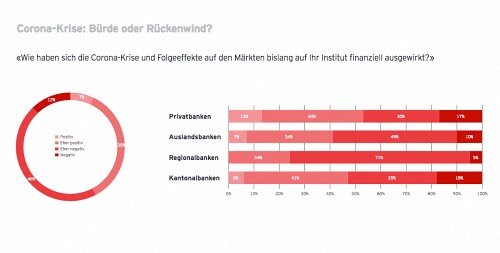

This result surprised the experienced financial services team at EY Switzerland: Three out of four regional banks surveyed complained that the Corona crisis and its consequences have had a rather negative financial impact on the institution. 5 percent even speak of clearly negative consequences, according to the current «EY Banking Barometer 2021», which the consulting firm published on Thursday. The barometer is based on the survey of 100 bank managers in the country, every fifth of them a regional banker.

Money advisers from the province are also quite pessimistic about the future. For the next twelve months, 67 percent fear negative or rather negative effects on the operating business – in other words, a drop in earnings of 10 percent or more (see chart below). Over the next three years, more than half of regional bank CEOs still harbor such fears.

Trade Missing

«Regional banks will be hit hardest by the fallout from the Corona crisis in 2021,» Patrick Schwaller, managing partner at EY Switzerland, told reporters. Loan defaults in particular could weigh more heavily on the banking group because they are heavily involved in the interest-earning business and primarily serve SMEs, which in turn tend to be more affected by the pandemic. «Likewise, the institutions do little securities trading, which has proven lucrative for the banks in recent months,» Schwaller added.

This is the first time in a long time that a hitherto extremely robust profession has begun to falter. Unlike the big and private banks, the banks were spared the consequences of the financial crisis and the tax dispute with foreign countries – instead, they benefited from the local real estate boom and their proximity to customers. Digitization also did not cause excessive pressure, and the supervisory authorities even accommodated the institutions with the so-called small-bank regime.

Massive Increase in Loan Defaults

The corona crisis is now strongly shaking these pillars. According to the EY survey, Swiss banks as a whole expect loan loss provisions to rise sharply in 2021. Thirty-six percent expect loan losses in the mortgage sector to increase sharply; this compares with only 7 percent in the previous year. For SME loans, 75 percent expect a need for loan loss provisions, up from 12 percent in last year's survey.

However, as Schwaller pointed out on Thursday, the drastic increase in mortgages, on the one hand, should be viewed in the context of the extremely low loan defaults of past years. However, EY does not expect a real estate crash or a prolonged wave of unemployment in Switzerland – the most important triggers for a default by mortgage borrowers. Meanwhile, the regional bankers surveyed expect their SME clients to emerge from the corona trough by 2023 at the latest.

Another Decade of Low Interest Rates

Nevertheless, the all-clear is not sounded in the interest rate business. A normalization of monetary policy has receded into the distance with the additional expansion of the money supply by the central banks as a result of the corona crisis. At 82 percent, the vast majority of banks believe that interest rates in Switzerland will still be very low in ten years' time. «This outlook exacerbates the banks' structural earnings problems and the erosion of margins in the important interest-earning business that has already been going on for several years,» Schwaller said.

Bad news for regional banks, which generally depend heavily on this business. Where the «breaking point» lies for the institutions will become clear in the coming months.

In the meantime, it is already clear that the Corona crisis and the accompanying shift to online channels has changed the relationship regional banks have with customers. Among the various banking groups, according to the survey, these institutions are also the most likely to assume that the digital structural change will have a strong and accelerated impact on the business model.

Is Consolidation on the Way?

The increased transparency made possible by digital comparison platforms has consequences for loyalty. Next to the cantonal banks, the regional banks are feeling this the most: 70 percent report that customer loyalty has decreased noticeably. This calls into question what is probably the most important «asset» of the institutions, namely local proximity to the clientele. Accordingly, the institutions see improving the customer experience – especially at contact points – as the most important lever for future earnings growth.

However, since this will probably involve considerable investment in the (digital) infrastructure, the usually small regional banks will be challenged. Increasingly, they will no longer be able to handle everything on their own. This brings a trend into focus that has been almost non-existent in this banking segment up to now: consolidation. Schwaller from EY says: «With a view to their margins, the regional banks will also have to go over the books.»