The fiascoes which cost Credit Suisse billions have riled Switzerland’s Social Democrats who are seeking to put an end to bonuses at the country’s two big banks.

Switzerland’s Social Democratic Party (SP) wants to ban bonuses for top management at the country’s systemically important banks.

A relevant motion (in German) has been put forward by SP member of the lower house of parliament, Prisca Birrer-Heimo.

«The recent events at Credit Suisse – the losses running into billions from Archegos and Greensill – show how bonus-driven incentive systems promote a gung-ho culture and that risk and compliance systems are totally neglected. The pursuit of profits and bonuses causes serious harm to clients and shareholders. In the case of systemically important banks both the state and tax payers are also affected. At the end of the day it is ordinary citizens who carry the financial risk,» the motion said.

Over $100 Billion Unweighted Equity

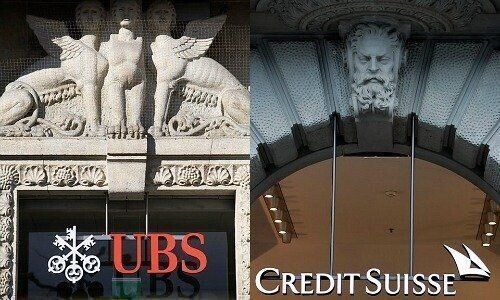

The SP wants to reduce this risk. In a second motion put forward by Birrer-Heimo, the party is demanding a massive hike in Credit Suisse and UBS’ unweighted equity to 15 percent. In addition the progressive elements, which envisage a greater rise in the big banks’ capital cushion as they grow should be strengthened, the motion said.

Shrinking Only Choice

According to the Zurich-based «Sonntagszeitung» (in German behind paywall), which reported on both motions over the weekend this would mean the two banks having to build up a capital cushion of 92 billion Swiss francs ($101 billion) each. This would mean the only choice for UBS and Credit Suisse would be a massive reduction in their balanced sheets as they would not be able to build up that amount of capital, even over a longer period of time.