The same day the Lehman bankruptcy file was closed, the Bank of England opened its financial arsenal and rushed to the aid of the markets with a support operation. What does Finma have to say about this?

With the gloomy economic outlook, the threat of further interest rate hikes, and now gas flowing in the Baltic Sea rather than into shipping terminals, nerves in the financial sector are currently on a keen edge. To see just how the nervousness has spread, one just needs to look to Great Britain.

On Wednesday the Bank of England (BoE) announced it would buy long-dated government bonds until mid-October without naming an upper limit due to market disruptions. The background to this is the considerable rise in yields on fixed-interest bonds in recent days. Haven't we seen this movie before?

Moreover, recently unveiled tax cuts of the new government of Liz Truss ignited fears these would ultimately lead to escalating government debt and even higher inflation.

Bond Crash

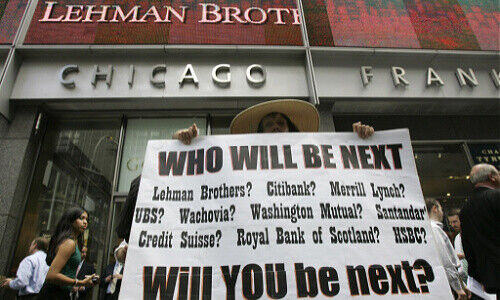

Had the BoE not intervened directly in the market, this could have bankrupted British pension funds and triggered a chain reaction, market observers fear. The term Lehman 2.0 brings back memories of a past bond crash and the bankruptcy of the US investment bank Lehman Brothers.

The bankruptcy of what was at the time the fourth-largest investment bank in the US on September 15, 2008, was the culmination of the global financial crisis and sent ripples through the capital markets.

Inescapable Irony

Lehman's collapse led to a heated debate about whether and under what circumstances companies should be bailed out. While customers of Lehman Brothers who had suffered losses often came away empty-handed, the administrators of the charred remains of Lehman and the interim management were able to cash in big time.

The irony, or perhaps tragedy, is that the Lehman proceedings were finally wound up the same Wednesday that the BoE rushed to the aid of the markets because of fears of a new Lehman moment is inescapable.

Finma All-Clear

There is a more optimistic tone from the ranks of the Swiss Financial Market Supervisory Authority (Finma). The institutions head, Urban Angehrn, explained at an event on Thursday, the past few months of crisis have shown that Swiss institutions are far better positioned than they were ten years ago thanks to the guardrails they have put in place.

The capital and liquidity buffers are indispensable because they cushion shocks and provide confidence, he said. Finma is monitoring the development of these buffers very closely as part of its forward-looking supervision.

History Lessons

Nevertheless, Lehman trustee James Giddens who oversaw the liquidation of the US bank comes to a different conclusion. For him, the lesson of the case is that the collapse of a major financial institution should be averted, but history teaches us, such things are inevitable.