EFG International is parachuting in a new CEO, mid-way through a critical phase in a merger. finews.com tells the backstory of how the Swiss bank grappled with the unexpected.

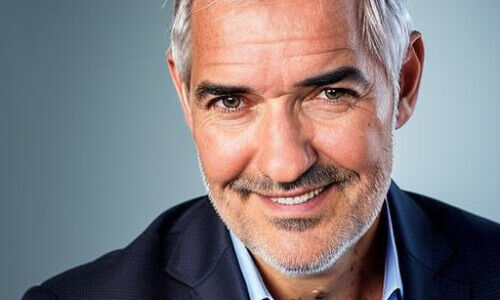

Giorgio Pradelli, a 50-year-old Italian and veteran of various Latsis family-controlled financial firms, is the natural choice to run EFG International, the Swiss private bank which is publicly listed in Zurich.

Nevertheless his appointment on Wednesday raised eyebrows among private banking observers. His predecessor, Joachim «Joe» Straehle has signaled that he wouldn't overstay his welcome, but certainly stick around long enough to stabilize EFG after the bank got more than it bargained for when it bought Banca della Svizzera Italiana, or BSI.

The Ticino-based firm lost its license in Singapore for washing 1MDB money, and is also being rapped by the central bank of Italy, where it may be forced to shut two offices.

Sacked, or Power Struggle?

Ultimately, the departure of Straehle, a veteran Credit Suisse private banker who formerly ran Basle-based Bank Sarasin, was as odd as his arrival. In 2015, Straehle originally came out of retirement to become EFG’s new chairman. At the last minute, he effectively traded jobs with then-CEO John Williamson: Straehle became CEO, Williamson moved upstairs as board chairman.

CEOs aren’t expected to telegraph their retirement plans, but Straehle's abrupt decision to leave at year-end comes as the newly-merged EFG and BSI requires a full-court press from management.

Was the CEO fired, the victim of an internal power struggle, or did he run afoul of 71-year-old Spiros Latsis, EFG’s family controlling shareholder?

Personal Reasons

None of the above: Straehle is battling health issues, according to several people familiar with the matter. He has guarded the precise nature of them from all but his innermost circle, they said. Efforts to reach Straehle were unsuccessful.

Thus, the baton passes to Pradelli, an entirely uncontroversial succession plan internally because he has been the bank's deputy head for nearly four years now. Despite the role as well as that of finance chief, which he also holds, he is largely unknown to the wider banking community.

«He’s not very well-known because he is not a person who courts controversy or publicity,» a peer said of the Turin native.

Latsis Intimus

Pradelli spent the last 14 years at various EFG firms, but began his career at Deutsche Bank’s private bank in Italy in 1991. He quickly advanced there, moving on to roles in wealth and asset management in Frankfurt and in London, where he made a name for building out onshore private banking markets.

In 2003, he joined the Latsis’ financial holding company. His big break came just three years later, when he was dispatched to EFG Eurobank, the Latsis’ bank in Greece. As international head, he earned plaudits for expanding into eastern Europe; much of the holdings were sold off following the financial crisis of 2008-09.

He is praised by colleagues for understanding the wealth management business from the ground up, being even-tempered, hard-working, very capable and eloquent. Clearly, he gets along well with the Latsis family, and will already be a familiar face in the private bank’s boardroom due to his role as finance chief and Straehle's number-two man.

Spearheading IT

Pradelli speaks 6 languages, four of them fluently including German from his time with Deutsche Bank (he also knows Greek). If he is acceding to the throne faster than expected due to Straehle’s decision, Pradelli could not be better prepared to face the challenges at EFG, which finews.com has reported on detail.

He has been integrally involved in the BSI takeover as well as the dicey information technology migration, which he is spearheading. Pradelli also currently oversees EFG’s treasury as well as legal issues, which means he has intimate knowledge of the gravity of the bank’s skirmish with Italian regulators.

For a bank which has almost made a habit of eyebrow-raising management changes since its boom-bust financial crisis years, Pradelli’s appointment looks well-thought-out and sensible.