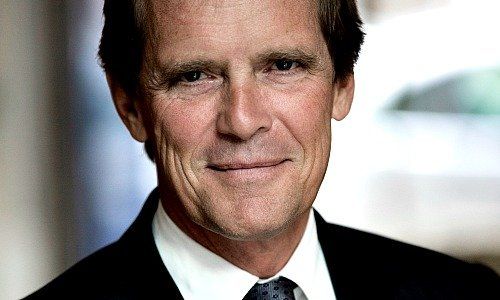

France’s La Financière de l’Echiquier harbors grand plans for the Swiss market. Chairman and CEO Didier Le Menestrel told finews.com in an exclusive interview how the asset manager plans to extend its reach beyond its mainstay of France.

La Financière de l’Echiquier (LFDE) is a niche player in the French asset management industry. With equity funds such as «Agressor» and «Major», the company founded by Chairman and CEO Didier Le Menestrel attracted assets worth some 8.8 billion euros in its 26 years of existence.

Today, the company is the fifth-largest independent asset manager in France and growing rapidly. Le Menestrel says that he pursues one strategic goal only: «Growth. If a company doesn’t grow, it dies.»

Rapid Expansion in Europe

Having stuck to what it knew best for a long time, LFDE now wants to rapidly expand its business abroad. Le Menestrel (pictured below) is adamant that as a niche player in France, to reach beyond 15 billion euros in assets, growing in Europe is mandatory.

One of the countries LFDE has identified as a target market is Switzerland: «Being accepted by the big players such as UBS and Credit Suisse opens you the world.»

Zurich – the Holy Grail

The chess players of LFDE – the company derives its name from the namesake road in the French capital, close to Porte Saint-Denis – are yet a few steps away from reaching the holy grail of Swiss banking, as Le Menestrel chose to put it in an interview at the company’s headquarters, which lies a few steps from L’Arc de Triomphe in Paris.

One-and-a-half years ago, LFDE sent Benjamin Canlorbe to Switzerland to open an office in Geneva. As country manager, Canlorbe received the mission to first open the private-banking industry in Geneva for the products sold by the French.

Le Menestrel expects Canlorbe to present his progress in the coming months before giving him more staff to extend his reach to Lausanne, Bern and – eventually – Zurich.

The CEO Doubles Up as Talent-Spotter

Apart from Geneva, LFDE also has representatives in Germany and Italy. The Benelux countries are further markets that the company extended its services to: «We will hire more people in those places to strengthen our business,» said the CEO. Currently, LFDE has 103 employees, who Le Menestrel prides himself of having handpicked personally.

The company will hire further people, but the boss would also be more than happy to acquire a competitor too if the chance arose: «Today is the time for consolidation and a need for growth,» he said.

Digitization as an Opportunity for Niche Players

The need to grow the business stems partly from digitization. Margins have come under pressure because there is greater transparency among competitors and prices decline with intermediaries being forced out of the market. «Digitization is an opportunity to make our business more efficient and faster,» said Le Menestrel. «The new technologies allow us to analyze a greater number of companies across the globe. This is a huge opportunity for niche players, who can go out and buy companies anywhere in the world.»

On that note, Le Menestrel finishes the interview and leaves his executive office to go into a meeting with companies which vie to provide the latest in fintech solutions to the asset manager with the name that makes anybody but the French wince.