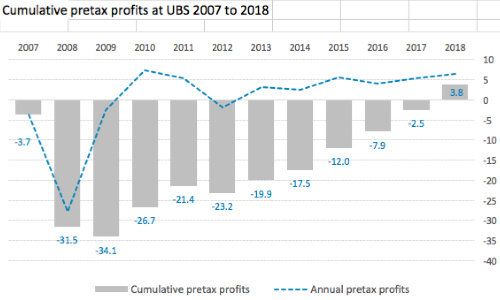

UBS’ Sergio Ermotti has quietly drawn a definitive line under the Swiss bank’s nearly $30 billion in losses during the 2008/09 financial crisis.

The Swiss bank’s fourth-quarter result was taken badly: investors sent the shares nearly five percent lower on the day after CEO Sergio Ermotti reported a $4.9 billion profit for the year.

Despite being riddled with weakness, as finews.com reported, the fourth quarter marks the first time that UBS’ profits since the crisis tally up to the nearly 30 billion Swiss francs ($30.1 billion) in crisis-time losses.

Switzerland was one of the first states to exit bank stakes taken in a massive shore-up of the financial system in 2008. The goal was «an adequate return for the taxpayer,» Marco Illy, the renowned investment banker who handled the sale, told this journalist at the time.

And at least one shareholder got it: the Swiss government was mid-2009 rewarded with a profit of more than $1 billion for its prescience. At that time, the U.K., Germany, the Netherlands and Belgium were still sitting on their part or full ownership of major banks.

Thirteen months ago, Ermotti and former Bank of England Governor Paul Tucker crossed swords over the losses, taxes, and bonuses, as finews.com reported. The bank under Ermotti, who described restoring UBS’ luster as a big part of his role when he took the top UBS job in 2011, has definitively cleared those losses.