A free bank account within minutes: the promise by Revolut to clients was hugely successful, also in Switzerland. But now, hundreds of customers are waiting for weeks to get their assets unfrozen – a persistent problem, it seems.

The announcement by the British neobank of new services tends to cause a groundswell of dissent in social media. Revolut clients regularly take the opportunity to remind the world of their plight and the freezing of accounts.

The cases of frozen accounts that take weeks to unlock aren’t isolated cases only. The cries for help on social media platforms are vocal and numerous, with hundreds of people seeking help to get their money unblocked. They feel neglected by the fintech – Europe’s most valuable. The company has some 12 million clients in 35 markets, 350,000 of which are based in Switzerland.

The End of a Chat

One example of a client who’s spoken to finews.com: a woman who has been waiting for seven weeks for her account to be unlocked. A series of smaller payments had the alarm bells ringing at the fintech, which suspected a case of money laundering. The bank demanded the client to send her tax statement and subsequently those of people who had sent her the money.

When she failed to provide the tax statements of those other people, Revolut simply blocked her account – apparently without giving due notice. And since then, the money has remained blocked. The daily requests to chat with the customer service online remained unanswered.

«Oh My God»

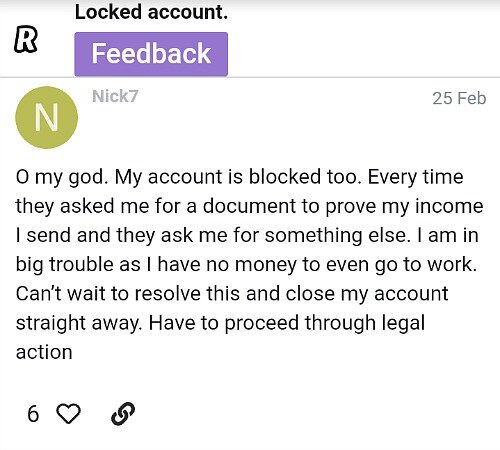

There are numerous others with similar experiences. In a Revolut support forum there are almost 500 reports from clients, dating back to the end of 2017 and right through August last. A Nick7 for instance claims that each time he sends them a document, he will get a request for another one. But without access to his account, he can’t even pay the fare to get to his job – which leaves him with one option only, and that is fighting his corner in the courts.

The bank commented as follows to the allegations: «Revolut, like all financial institutions, is obliged to conduct customer due diligence checks (CDD) on new and existing customers. These checks may involve verification of the source of the funds credited on the user’s account, as well as the source of their income. This could include requests of documents to verify the sources of funds. At any given time a very small number of our 12 million customers around the world may be experiencing a suspension of their account due to these CDD checks, a breach of our terms and conditions or as part of our security checks which continuously monitor to keep our customers safe.»

Surveillance Turned Off

But in fact, Revolut is having a persistent problem with the blocked accounts, a procedure that is not far from confiscation in its effect. Revolut in 2018 received so many accounts of suspicious behavior that the fintech simply turned off the surveillance service. That in turn backfired, because it became public and the chief financial officer had to leave.

Revolut rejects the allegations that it turned off its surveillance system: «While we are aware of historic press speculation regarding our internal compliance systems no such adverse finding by any regulatory authority was or has been made. In July 2018, we conducted a trial of a new sanctions screening system that went above and beyond the industry standard. During that trial, we experienced an issue whereby a greater number of transactions were being flagged for further checks than was necessary, so we decided to pause the trial until this could be rectified. Throughout this process our original compliance system was running in parallel. To be clear, at no point did Revolut stop checking transactions for sanctions compliance. Nor was there any failure in our sanctions screening procedures.»

Furthermore, the company also says it is incorrect to say that ex-CFO Peter O’Higgins was in any way compelled to leave Revolut as a result of the false speculation relating to the compliance enhancement roll-out: «Mr O’Higgins resignation was in fact unrelated to this matter or any associated press coverage. In fact he left due to his belief that Revolut required someone with global retail banking experience to fill the role of chief financial officer at a time where the business was preparing to apply to become a licensed bank in various jurisdictions.»

In February though, the bank angered Priorité, a company that works closely with the government of France.

The bank blocked two accounts with a total of 300,000 euros without giving a reason, for a full six weeks, according to die britische Zeitung «The Times» (behind paywall). Which suggested that algorithms were still in charge at the fintech.

Established Players: Firing Back

The cases may badly backfire, because the complaints by clients tend to go viral. Which helps the traditional banks to keep their operations going. And they have been playing catching-up with the fintechs. Credit Suisse for instance will launch a digital offering with accounts and cards in October. The aim of this new service is pretty obvious.