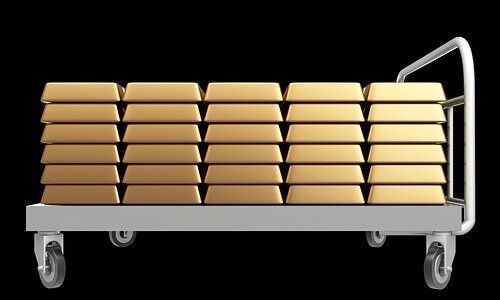

The Swiss central bank posted a more than handsome profit for the first three quarters of the year, largely thanks to a surge in the valuation of its gold reserves.

The Swiss National Bank (SNB) recorded a profit of 15.1 billion Swiss francs ($16.5 billion) for the nine months through September, according to a statement released on Friday. The main driver of the profit, which was less than a third of what the bank generated in the same period of 2019 ($51.5 billion), was the price of gold.

A kilogram of gold was worth 55,989 francs at the end of the reporting period, up from 47,222 francs at the end of 2019. The valuation gain amounted to 9.1 billion francs.

Exchange Rate-Related Losses

Foreign currency positions added a further 5.3 billion francs, with interest and dividend income amounting to 6.1 billion and 2.6 billion francs respectively. Interest-bearing paper and instruments had a price gain of 11.7 billion and equities and instruments registered a gain of 7.1 billion. By contrast, exchange rate-related losses totaled 22.3 billion francs.

The profit on Swiss franc positions totaled 1 billion francs. It largely resulted from negative interest charged on sight deposit account balances.