The major Swiss banking groups are increasingly diverging with their set of agendas, and big egos are further deepening the rift.

1.The Bankers Association «Unites» What Is Drifting Apart

The Swiss Bankers Association (SBA) is the representative of an era that is fading. Banking is undergoing fundamental structural change, with the prevailing conditions, business models, and interests drifting apart. Also, the fight over market share in the domestic is getting harder.

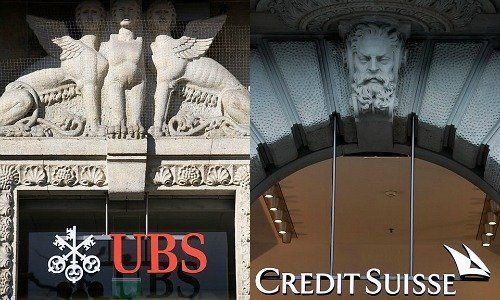

Switzerland has a fragmented banking industry, a mirror image of the structural change. Two global banking players (UBS and Credit Suisse), a string of globally active private banks, cantonal banks with their state guarantee, regional banks, and the local units of foreign bank – they all have particular sets of interests and agendas that may not fit those of other members of the SBA.

2. Guy Lachappelle – the Grassroots-Banker

The driving force behind the decision to break rank with SBA is Raiffeisen Chairman Guy Lachappelle. Since taking charge of the banking group, he has successfully rallied the often rural member banks behind the cooperative group level.

Insiders are saying that Lachappelle frequently clashed with UBS Chairman Axel Weber. Lachappelle was upset about the dominant behavior of the representatives of the big two, which pay millions to their bankers while struggling with the strategy and remaining bogged down by legal wrangles in other jurisdictions.

3. Regulation Reflects Concerns of the Big Two

The regulatory framework may have been adjusted to the needs of the smaller firms, but essentially remains a reflection of the concerns of the big two, something that irks the representatives of the smaller companies. They say that the big bank’s risky global games had prompted the wave of regulation which then also came to apply to domestic banks.

The domestic bankers are tired of hearing the complaints of the big about the regulation and capital requirements, said an insider. They are frustrated over the fact that despite a costly effort to comply with the markets in financial instruments directive II, most still don’t have free market access to the European Union.

4. Where’s the New Agenda?

Finance is undergoing seismic change. An analysis and assessment of the major driving forces behind this change are key because this will allow the identification of the main points. In the past, one such aspect was the automatic exchange of information, cooperation with global lobby groups, and the demand for the abolition of the stamp duty.

The SBA has failed to forward a new agenda for the coming years, despite the emergence of issues such as digitization, training requirements, and sustainability (ESG). A clear commitment and lobby activity to further these questions has been notable by its absence and the SBA seems to rest on its laurels, pushing surveys about reputation, statistics, or political questions instead. The group isn’t acting as the strong player that it is in principle, and Raiffeisen grew unhappy about it.

- Page 1 of 2

- Next >>