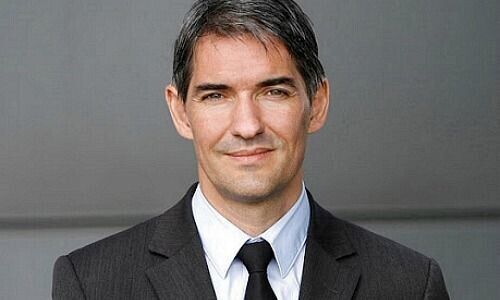

Ralph Ebert: «Compliance in the Light of Digital Transformation»

Global surveys on compliance risks in the financial industry show that a large majority of respondents agreed that innovative digital technologies have helped identify financial crime. A closer look reveals the direct correlation between financial crime awareness and the use of technology to detect and prevent it, Ralph Ebert writes in an essay for finews.first.

This article is published on finews.first, a forum for authors specialized in economic and financial topics.

Technology, data and automation in the financial industry are not only business enablers, they can also act as transformers. This is, in particular, valid for compliance which had to integrate innovative technology and data as a key tool to reduce the risk, at the same time to reply to a heightened regulatory demand, manage a stressful COVID-19 pandemic situation and finally face cost reduction exercises.

In order to address these contradicting purposes, financial institutions need not only a creative mindset but more important an in-depth understanding of the data model. The way financial institutions live the Know-Your-Customer (KYC) principle from a regulatory perspective is entirely depending on the outcome of the «Know-Your-Data» question.

«You cannot fight what you do not see» would be a more comprehensive view of this market development»

Global surveys on compliance risks in the financial industry show that a large majority of respondents agreed that innovative digital technologies have helped identify financial crime. A closer look reveals the direct correlation between financial crime awareness and the use of technology to detect and prevent it.

«You cannot fight what you do not see» would be a more comprehensive view of this market development. New technologies combined with artificial intelligence and self-learning components have achieved to bring more light in the dark – in particular to transaction monitoring with the identification of complex and multi-layer transactions as well as unusual transactional behaviors of clients.

Banks that understand to transform the regulatory burden for compliance into an opportunity to develop digital solutions have gained a significant advantage: For example, based on an «Economist» article the average cost of managing a high-risk client will cost the bank approximately $75,000 per year and per client – tremendous potential for reducing the costs with the implementation of digital solutions.

«Who is really driving the digital transformation process in the banking sector?»

However, the implementation of new technologies in the compliance framework has opened another «Pandora box» for banks in the wealth management sector: What technology do I really need for my exiting data infrastructure and who is the best provider to go to? In addition, the question is raised who is really driving the digital transformation process in the banking sector – banks based on regulatory demands or digital solution providers based on the permanent development of near-infinite digital solutions?

A short glimpse on the Swiss regtech startup map published by Swisscom (last update August 2021) confirms my view that the Swiss financial sector is the new «Eldorado» for all kinds of digital solution providers: Currently, 40 companies offer digital solutions in areas such as authentication, regulatory mapping, enterprise risk management etc.

«Know your data – and a successful journey in four steps towards digital compliance»

- Step 1: A successful data management and technology strategy for compliance must have a vision of the digital transformation: How should the technology support the Compliance function and what are the topics to cover? It is key to have a concrete vision of how a day in Compliance will look alike with the support of digital solutions. Compliance officers are often stuck searching for critical data and do not dispose of a connected approach to the technology that supports their program. They want and need a system that stores data in a single repository with standardized data including dashboards and task lists in a unified compliance suite solution.

- Step 2: The foundation –know-your-data! To avoid «digital odysseys» in the transformation process, banks will need to have a detailed and solid knowledge of how data is handled in the business from the moment it is created, from the edge to the data center. If the bank’s current overarching data management and infrastructure are not performing well, any digital compliance strategy will fail regardless of the capability of the solution provider. Like in personal growth approaches will a digital transformation process only provides healing if the personal self-assessment on data management has been performed in-depth beforehand. This concerns as well to identifying the «dark data», essentially any data owned by an organization that it has not categorized or is unaware of, which is the enemy of data intelligence. If an organization does not know what data it has or what it means to its activity, the data is worthless.

- Step 3: Data analytics is essential for banks looking to increase efficiency, improve compliance decision-making and identify gaps in the current Compliance control framework. This includes as well an assessment of the serverless applications. This needs to be handled via Application Programming Interfaces (APIs) across API vendors, irrespective of where the data resides.

- Step 4: Risk and focused-based digital approach for compliance for choosing the right partner.

The current landscape of compliance technology is composed of many disparate systems that do not integrate with each other. Based on the outcome of the data analysis, the data model as well as the identified shortcomings in the compliance control framework, a digital solution implementation should focus to resolve in the first phase the most sensitive compliance topic: On top of the compliance, wish-list is the enhancement of transaction monitoring, holistic case management tools for the on-boarding process as well as digital risk intelligence solutions to provide more efficiency to the client’s review process.

«The digital transformation has already caused the search of the new era compliance officer»

Successful digital solution implementation is very often achieved by opting for a «plug-and-play» solution that highly integrates into the existing solutions and offers agility via API solutions to plug in further digital solutions regardless of where the data resides. Such an approach offers as well value to the bank to integrate into the future new compliance technologies with the local core banking system even from other providers which means at the same timeless dependency to one provider.

Digitalization will continue to change the financial industry profoundly as well as the compliance function. Work and tasks will further shift from data/information identification and collection towards data analysis and validation. However, the digital transformation has already caused the search of the «new era compliance officer» who in addition to the compliance skillset will need a profound knowledge to use the digital tools and has a high data analytics affinity. This situation might create further opportunities for data specialists to enter the compliance world.

Ralph Ebert, a German lawyer, is active in legal and compliance for big and private banks with 15 years of experience. He currently works as head of compliance at Banque International à Luxembourg (BIL) in Switzerland. He previously worked in Seoul, Montreal and Paris, before moving to Switzerland in 2008. He worked for companies including BNP Paribas, Credit Suisse, UBP and Credit Agricole Indosuez. He specialized in the fight against money laundering. He also focuses on the integration of regtech solutions, consequences for compliance and the modern compliance culture.

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Ralph Ebert, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Claude Baumann, Markus Winkler, Konrad Hummler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Claudia Kraaz, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Karin M. Klossek, Nicolas Ramelet, Søren Bjønness, Andreas Britt, Gilles Prince, Salman Ahmed, Stephane Monier, and Peter van der Welle, Ken Orchard, Christian Gast, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Marionna Wegenstein, Kim Fournais, Carole Millet, Swetha Ramachandran, Brigitte Kaps, Thomas Stucki, Neil Shearing, Claude Baumann, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Niels Lan Doky, Karin M. Klossek, Ralph Ebert, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Bernardo Brunschwiler, Peter Schmid, Karam Hinduja, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Lars Jaeger, Andrew Isbester, Florin Baeriswyl, and Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch, Angela Agostini, Guy de Blonay, Tatjana Greil Castro, Jean-Baptiste Berthon, Marc Saint John Webb, Dietrich Goenemeyer, Mobeen Tahir, Didier Saint-Georges, Serge Tabachnik, Rolando Grandi, Vega Ibanez, Beat Wittmann, David Folkerts-Landau, Andreas Ita, Teodoro Cocca, Michael Welti, Mihkel Vitsur, Fabrizio Pagani, Roman Balzan, Todd Saligman, Christian Kaelin, Stuart Dunbar, Fernando Fernández, Lars Jaeger, Carina Schaurte, Birte Orth-Freese, Gun Woo, Lamara von Albertini, Philip Adler, Ramon Vogt, Gérard Piasko, Andrea Hoffmann, Niccolò Garzelli, Darren Williams, Benjamin Böhner, Mike Judith, Gregoire Bordier, Jared Cook, Henk Grootveld, Roman Gaus, Nicolas Faller, Anna Stünzi, Philipp Kaupke, Thomas Höhne-Sparborth, Fabrizio Pagani, and Taimur Hyat.