The complex problems of our world cannot be solved by numbers. And quantitative analysis will never be able to drive the positive social changes we need, Stuart Dunbar writes in an essay on finews.first.

This article is published on finews.first, a forum for authors specialized in economic and financial topics.

The desire to invest more sustainably has had unintended consequences: Mapping ESG values has degenerated into a dull exercise of measuring, ticking boxes and converting into scores. This has little to do with what sustainable investing should achieve.

The complex problems of our world cannot be solved by numbers. Quantitative analysis will never be able to drive the positive social changes we need. It will not help us increase the productivity of our economy, nor improve our living standards or ensure that our world remains livable. For this, we need to take a holistic approach, especially when it comes to sustainability, i.e. ESG issues.

«The weakness of quantitative ESG approaches can be clearly illustrated»

For many investors, sustainable investing means nothing more than buying a fund that passively mimics an ESG index. This approach is particularly widespread for climate-friendly investments. In principle, there is nothing wrong with investors wanting to achieve a more sustainable portfolio or one with a smaller carbon footprint. Dogged criticism is therefore not appropriate. And yet this approach is a misguided one: because if we base our investment decisions only on snapshots of metrics, we are a long way from sustainable asset formation that is aligned with a holistic ESG concept.

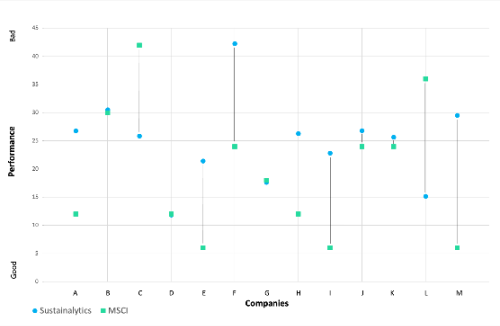

This is because the ESG metrics used to focus more on the systemic risks of a portfolio than on the opportunities made possible by the positive behavior of individual companies. The weakness of quantitative ESG approaches can be clearly illustrated by the contrasting ESG scores of different data providers on the same company (see chart).

(Click on the graphic)

But why are the scores so different? Because they are highly subjective. Asset managers and investors alike need to be aware of this. The ESG ratings they rely on may not match their own interpretation of responsible investing at the relevant time or in a particular area.

In our opinion, sustainable investing, therefore, requires a holistic and very specific approach: In particular, investors should engage with individual companies themselves and in a targeted way to find out whether and to what extent the companies are facing up to the challenges of the real world. This includes actively maintaining dialogue and encouraging companies to change and drive progress.

«This is precisely where the limited quantitative snapshot of corporate ESG assessment fails»

Our global society is structured in such a way that it needs many things produced by industries that are deemed to be harmful to the environment. International supply chains rely on airlines. Knowledge needs to be shared, and despite digitization, much of it is still only available in paper form. Food must be packaged. Roads, bridges and buildings need to be built – especially in developing countries.

The bottom line, in our view, is to focus on reducing the impact of these activities rather than pretending we can do without them. This is precisely where the limited quantitative snapshot of corporate ESG assessment fails. A thoughtful approach to sustainable growth, on the other hand, not only addresses the ESG challenges of our time, but it also opens investment opportunities.

«A meaningful approach to sustainable investing may be messy and difficult to quantify»

We are convinced that companies that meet society's needs and challenges will also be financially successful in the long run. After all, the capitalist motive of companies is not the enemy, it is the mechanism that spurs and harnesses human creativity and development. Of course, we must not forget that for sustainable progress we have to think in the long term. We must also assume that companies doing business in an irresponsible and harmful way will be held to account by their consumers, governments, regulators and investors – and made to change.

A meaningful approach to sustainable investing may be messy and difficult to quantify. But if investors integrate ESG factors and principles holistically into their analysis, focus on sustainability as an opportunity, and clearly explain the rationale behind their investment decisions, they can meet the real demands placed on them by the three ESG dimensions of sustainability.

Stuart Dunbar joined Baillie Gifford in 2003 and is a Director in the Clients Department. He became a Partner in the firm in 2014 and is responsible for overseeing relationships with financial institutions, as well as contributing to consultant relationships, marketing and client servicing activities in Europe and Asia. Prior to joining Baillie Gifford, Stuart worked with Dresdner RCM in Hong Kong and Aberdeen Asset Management in the U.K. He graduated BA in Finance and Business Law from the University of Strathclyde in 1993.

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Ralph Ebert, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Claude Baumann, Markus Winkler, Konrad Hummler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Claudia Kraaz, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Karin M. Klossek, Nicolas Ramelet, Søren Bjønness, Lamara von Albertini, Andreas Britt, Gilles Prince, Darren Willams, Salman Ahmed, Stephane Monier, and Peter van der Welle, Ken Orchard, Christian Gast, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Marionna Wegenstein, Kim Fournais, Carole Millet, Ralph Ebert, Swetha Ramachandran, Brigitte Kaps, Thomas Stucki, Neil Shearing, Claude Baumann, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Niels Lan Doky, Karin M. Klossek, Ralph Ebert, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Bernardo Brunschwiler, Peter Schmid, Karam Hinduja, Stuart Dunbar, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Gérard Piasko, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Lars Jaeger, Andrew Isbester, Florin Baeriswyl, and Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch, Angela Agostini, Guy de Blonay, Tatjana Greil Castro, Jean-Baptiste Berthon, Marc Saint John Webb, Dietrich Goenemeyer, Mobeen Tahir, Didier Saint-Georges, Serge Tabachnik, Rolando Grandi, Vega Ibanez, Beat Wittmann, Carina Schaurte, and David Folkerts-Landau, Andreas Ita, Teodoro Cocca, Michael Welti, Mihkel Vitsur, Fabrizio Pagani, Roman Balzan, Todd Saligman, and Christian Kaelin.