Much remains to be done to make financial inclusion a reality, Guy de Blonay writes in an essay for finews.first.

This article is published on finews.first, a forum for authors specialized in economic and financial topics.

Financial inclusion is about making individuals have access to basic financial services. It is a key enabler for some of the United Nations’ seventeen Sustainable Development Goals (SDN). The importance of financial inclusion was officially recognized in 2015 when the United Nations’ General Assembly passed a resolution stressing the need for «full and equal access to formal financial services for all».

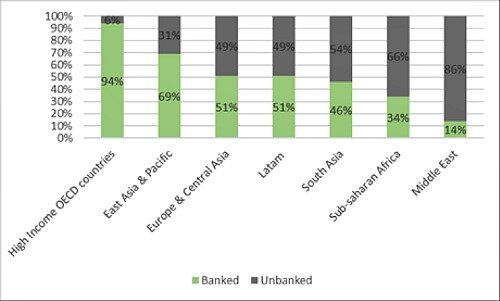

Much remains to be done to make financial inclusion a reality, however. Globally 1.7 billion people did not have a bank account in 2017 (World Bank). And this situation is disproportionately affecting vulnerable groups – such as low-income households, women and young people – in emerging markets.

Globally Around 1.7 Billion People Don’t Have a Bank Account

(Adults having a banking account as a percent of the adult population, source: World Bank)

Technology And Digital Finance Are Key Drivers of Financial Inclusion

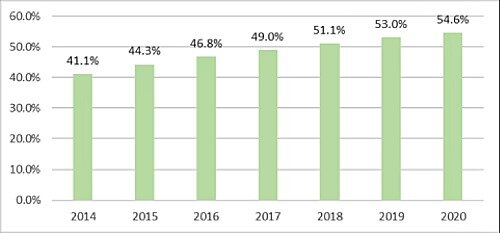

Historically, branches were the main driver of financial inclusion. However, they are often uneconomical outside of large urban areas and developed markets. The increase in internet penetration and the emergence of online and mobile banking have now created an opportunity to promote financial inclusion without relying on old branch networks. Digital finance is now seen as «the primary route for financial inclusion» by the United Nations Capital Development Fund.

The Penetration of Internet Services Is Increasing Steadily

(Percentage of internet users in the global population, source: eMarketer, April 2016)

Chinese Fintech Platforms Have Led The Way…

China is a good example of the way online and mobile banking can promote financial inclusion. Mobile payment applications like Ant’s AliPay and Tencent’s WeChat gained widespread acceptance in the last 10 years as QR codes and electronic payments displaced cash at the point of sales.

The near uniquity of Alibaba’s AliPay and Tencent’s WeChat has provided these companies with a platform to distribute financial services in a country where an estimated 224 million people did not have a bank account in 2017.

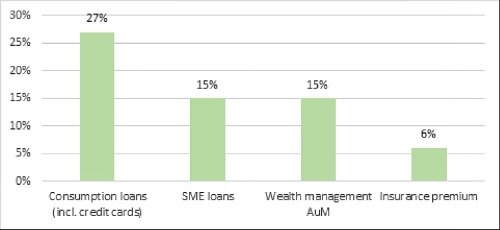

Ant Financial now sells lending, insurance and asset management products to a user base of over 1 billion individuals and 80 million small merchants. This new business has been growing twice as fast as the traditional payment business and represented 56 percent of the company’s revenues in 2019. At some point, Ant’s money market fund was the largest in the world with over RMB trillion of assets under management.

Online Represents a Growing Share of Financial Services in China

(China’s online penetration for various financial products, source: CLSA)

…But Are Now Facing Greater Regulatory Scrutiny

So far, companies like Ant Financial have acted as platforms. They provide access to clients as well as the data and technology required to assess the solvency of potential borrowers. But the traditional financial institutions are the ones that provide the funding and carry the risks.

This sharing of responsibilities has been beneficial for fintech companies. They were able to grow rapidly while avoiding the capital requirements and the risks that normally come with banking activities.

There are signs that public authorities are now concerned that this model could threaten the stability of the financial system. In China, the government first cracked down on peer-to-peer lending in 2018 following a series of scandals were investors found themselves unable to retrieve their savings.

Authorities are now trying to regulate the massive growth in online and micro-lending and are notably considering rules that would require the likes of Ant to take more loans on their own books. The ultimate goal seems two-fold: level the playing field with banks and make fintech players accountable for the risks on the loans they facilitate.

How to Access The Theme

There is a clear opportunity around financial inclusion however one has to be mindful of the regulatory risks.

In China, Alibaba (which owns a 33 percent stake in Ant) and Tencent could be impacted by changes in the regulatory framework. These risks already led Ant Financial to suspend its IPO in November 2020. In developed markets, payment platforms don’t yet enjoy the same level of ubiquity AliPay and Tencent have in China, and banks also tend to be more entrenched. However, there is still room to promote financial inclusion.

The Federal Deposit Insurance Corporation estimated that 6.5 percent of U.S. households did not have a bank account in 2017 (a proportion that reached 21 percent and 18 percent for the African American and Hispanic communities). An additional 18.7 percent of U.S. households were considered to be «under-banked». Innovative players are starting to take steps to address this untapped market.

Paypal Inc. offers Venmo, a payment app and digital wallet for millennials, and Xoom, a digital wallet solution that has become widely used by migrants in the United States – not all of whom would have bank accounts – to send money to relatives back in their home countries.

Square Inc. is famous for providing payment acceptance services to micro-merchants that are under-served by banks. It also offers a payment wallet similar to Venmo called CashApp. The function gained significant traction this year and has been extensively leveraged by the U.S. government to provide stimulus money to individuals and small businesses affected by the pandemic.

Paypal’s Venmo and Square’s CashApp already have over 60 million and 30 million users respectively.

Guy de Blonay joined Jupiter Asset Management in 1995 and is currently a fund manager in the global team. He is the manager of the Jupiter Financial Opportunities Fund and the Jupiter International Financials Fund (Unit Trusts) as well as the Jupiter Financial Innovation fund (SICAV). In 2001, Guy joined New Star (which was subsequently taken over by Henderson) where he managed global financial equities. He returned to Jupiter in January 2010, initially in an advisory capacity, before again assuming fund management responsibilities in June 2010.

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Ralph Ebert, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Claude Baumann, Markus Winkler, Konrad Hummler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Claudia Kraaz, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Karin M. Klossek, Nicolas Ramelet, Søren Bjønness, Lamara von Albertini, Andreas Britt, Gilles Prince, Darren Willams, Salman Ahmed, Stephane Monier, and Peter van der Welle, Beat Wittmann, Ken Orchard, Christian Gast, Didier Saint-Georges, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Marionna Wegenstein, Kim Fournais, Carole Millet, Ralph Ebert, Swetha Ramachandran, Brigitte Kaps, Thomas Stucki, Teodoro Cocca, Neil Shearing, Claude Baumann, Guy de Blonay, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Fabrizio Pagani, Niels Lan Doky, Karin M. Klossek, Ralph Ebert, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Beat Wittmann, Bernardo Brunschwiler, Peter Schmid, Karam Hinduja, Stuart Dunbar, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Gérard Piasko, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Lars Jaeger, Andrew Isbester, Florin Baeriswyl, and Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Michael Welti, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch and Angela Agostini.