Predicting volatility is paramount to achieving optimal performance for risk-based strategies. Investors have previously relied on historical data, but incorporating implied volatility can provide a more informative perspective, Serge Tabachnik writes in an article on finews.first.

This article is published on finews.first, a forum for authors specialized in economic and financial topics.

Traditional approaches to volatility estimation and forecasting rely on multiple forms of filtering past or historical data through various kernels. However, the COVID-19 crisis has served as a reminder that abrupt regime changes tend not to be well identified by rear-view metrics, leaving investors at a potential disadvantage.

Implied volatility indices provide a useful measure of market participants’ expectations about future realized volatility. For example, the «fear gauge», otherwise known as the VIX, is a real-time implied volatility index that provides a view of market participants’ expectations of 30-day forward-looking volatility.

Historical Volatility

Implied volatility indices derive their value from options prices, from which implied uncertainty levels of the underlying securities are calculated in a non-linear way.

Our study of a volatility-targeting strategy on S&P 500 futures finds that the volatility target is exceeded by more than 20 percent when using the historical volatility estimate and underused by a similar margin when using the raw VIX value. The adjusted VIX measure – based on the historical relationship between implied and realized volatility – however, is almost perfectly on target.

Promising Results

We can see signs of improvement across several key metrics as a consequence of this methodology, which denotes the strong benefit of forward-looking information contained in implied volatility.

This methodology also bears promising results when extended to several developed/emerging equity and credit markets that exhibit significant sensitivities to the VIX Index. Identical conclusions to the S&P 500 futures test case are reached on three equity and credit markets.

It is quite remarkable that a single IV index – the VIX Index – possesses forecasting power to predict the volatility not only of its underlying (the S&P 500 index, which spans 500 leading US companies and captures approximately 80 percent coverage of available U.S. market capitalization), but also of different geographical and structural markets.

Risk-Based Portfolios

To our knowledge, the combination of both historical and forward-looking volatility estimates is novel in the multi-asset investment management community and more specifically in the context of risk-based portfolios.

While this note focuses on a few generic markets, our research has shown that similar benefits can be reaped in other international equity or credit markets, as well as in other asset classes such as fixed income, currencies and commodities.

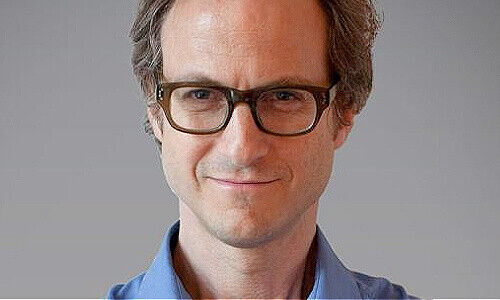

Serge Tabachnik is head of research for LOIM’s Multi-Asset Group. Prior to joining in December 2018, he was CEO and founder of Antares Technologies, an investment company seeded by Paloma Partners, partially sold in 2017/18 to Two Sigma Investments. Prior to his career in finance, he was a Postdoctoral Fellow at Princeton University’s Department of Astrophysical Sciences and lectured at Oxford University and the Swiss Federal Institute of Technology in Lausanne (EPFL). He holds a Ph.D. in Theoretical Physics from Oxford University and a master’s degree in Theoretical Physics from both EPFL and École Polytechnique in Paris. He currently lectures as part of the financial engineering department at University Paris 2. He started his investment career at Amaranth in 2003, as a senior risk strategist. In May of 2006, he moved to CFM (Capital Fund Management) as head of Yield Arbitrage.

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Ralph Ebert, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Claude Baumann, Markus Winkler, Konrad Hummler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Claudia Kraaz, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Karin M. Klossek, Nicolas Ramelet, Søren Bjønness, Lamara von Albertini, Andreas Britt, Gilles Prince, Darren Willams, Salman Ahmed, Stephane Monier, and Peter van der Welle, Beat Wittmann, Ken Orchard, Christian Gast, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Marionna Wegenstein, Kim Fournais, Carole Millet, Ralph Ebert, Swetha Ramachandran, Brigitte Kaps, Thomas Stucki, Teodoro Cocca, Neil Shearing, Claude Baumann, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Fabrizio Pagani, Niels Lan Doky, Karin M. Klossek, Ralph Ebert, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Beat Wittmann, Bernardo Brunschwiler, Peter Schmid, Karam Hinduja, Stuart Dunbar, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Gérard Piasko, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Lars Jaeger, Andrew Isbester, Florin Baeriswyl, and Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Michael Welti, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch, Angela Agostini, Guy de Blonay, Tatjana Greil Castro, Jean-Baptiste Berthon, Marc Saint John Webb, Dietrich Groenemeyer, Mobeen Tahir, and Didier Saint-Georges.