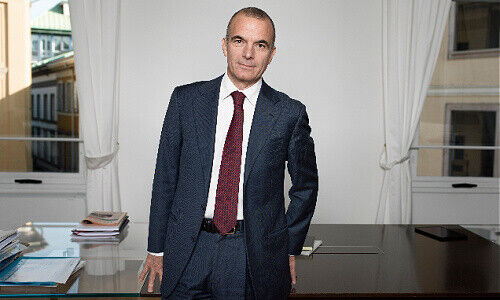

He is probably the most influential private banker in Italy. In an interview with finews.com, Tommaso Corcos talks about Geneva-based Bank Reyl’s future after being fully integrated with Intesa Sanpaolo. We also find out why a picture of U.S. astronaut Edwin «Buzz» Aldrin hangs in his office.

Tommaso Corcos, Private Banking is a global business. But are there any differences in the definition and methodology between Italy and Switzerland?

Fundamentally, private banking is about taking a holistic approach. It is not just about performance, but the way a client’s assets develop. There are many different aspects around that. These include diversification, personal needs, residency, tax status, and inheritance. In the classical sense, it is about the relationship with clients, much of which involves trust.

There are few differences; in Italy product distribution in private banking is different and we have a larger diffusion of discretionary managed investment solutions. A great deal of work is done through (i.e. Lombard) credit with low-risk absorption. Clients just started having also an affinity for private market assets, like private equity, investments that have no, or very little, correlation with publicly listed equities. The market is domestic dominated by Italian clients.

«Our strategy abroad follows that of many Italian companies»

In contrast with that, Switzerland remains an excellent offshore financial hub with a very high percentage of overseas clients. It has a stable judicial system and sophisticated financial market regulation. Since we developed our Swiss private bank business (with Morval and Reyl acquisitions) we have benefited from both.

Who are your clients?

About 300 billion euros of the total 350 billion that we manage are from Italy. That means that our clients are mostly domestic, or onshore. They are spread throughout the country, although there is a clear center of gravity in the north, given that it is where the economic activities are mostly based. Most clients who are not Italian are booked in Switzerland and some in Dubai.

Our strategy abroad follows that of many Italian companies. For example, in the Middle East, the development of Private Banking usually follows the Corporate Banking activity of the Intesa Sanpaolo Group.

Has Fideuram Intesa Sanpaolo Private Banking (Fideuram-ISPB) been impacted by the EU sanctions against Russian oligarchs and the country’s other citizens?

The Russian market is not a market we have ever looked at. On the other hand, the effects of the war in terms of poor financial market performance, high inflation, supply chains, commodity outages and consequent price increases have had a substantially greater impact on our clients.

Last year, in contrast, was a dream for banks and the Italian economy. The share price of Intesa Sanpaolo rose by 18,9 percent in 2021. Why is that?

Simply put, it is because of the «Draghi Effect». Mario Draghi has been the first Italian prime minister for a very long time who led and implemented a business agenda that is dependable and allows for planning.

«Gideon Rachman's book shows clearly how the understanding of democracy is on the wane»

Our country has benefited very much from the next generation EU program which to a certain extent has given the younger generation new perspectives. Even the «Financial Times» (FT), which was once highly critical of Italy, has been full of praise for Mario Draghi and his leadership, ranking it even more highly than Germany’s former chancellor Angela Merkel.

But there is little use in basking in last year’s successes since so much has changed since the beginning of the year. The world is in a completely new situation, one that is full of uncertainties and threats. A book by FT author Gideon Rachman, «The Age of the Strongman», shows very clearly how the understanding of democracy is on the wane or even disappearing, in many parts of the world. It has even become apparent in some Western European countries.

Do these developments have consequences for banks, particularly Fideuram-ISPB?

I do think they do. It has become more important to know what a brand stands for, and what values it represents. It must be grounded in a culture that goes beyond just thinking about profit.

That sounds good – but what does it mean in detail?

Banks have an institutional significance and a societal responsibility. We saw that with the pandemic, when banks lent to small and medium-sized businesses, supporting the economy. This social component is tremendously important for an economy ‘ it influences the perception of banks in society.

Fideuram-ISPB is by far the largest private bank in Italy. What helped it reach the top?

The conscientiousness about our brand we touched on before. Diverse takeovers in recent years have helped as well. We have a stronger focus on private banking, more so than any other Italian bank. That explains the significant difference compared with our competitors.

Fideuram-ISPB only really appeared in the Swiss market in 2020. That was when you bought a 69 percent stake in Reyl. How did that come about?

In August 2017 we announced the agreement to buy Geneva private bank Banque Morval. Switzerland, Luxemburg, and London were our most important target markets before Brexit. And that is where you need to be if you want international success. It was clear to us that we could not grow by our own means. But still, even after that, we didn’t have critical mass.

Why did you choose Bank Reyl in the end?

What we liked about Reyl was the partner-led approach, the entrepreneurship, and its international character and experience. It was also due to its innovative nature and digital experience as well as asset management know-how, particularly in impact investing.

«There are bad news and leaks everywhere»

Reyl was also able to profit by having an international financial institute supporting it that helped it massively expand its distribution capabilities and lend a balance sheet that opened entirely new perspectives.

Did you look at other Swiss private banks?

We would not be doing our homework if we were not constantly looking at the sector. We always examine what our competitors are doing, how they are performing and if there are any opportunities for synergies.

What makes Switzerland attractive to Italian banks?

As I mentioned, it is the dependable legal system, the longstanding banking tradition and the know-how that comes with that. Also, the political stability, the strength of the currency, solid infrastructure, cultural and linguistic diversity.

But the finance sector is always making headlines with diverse scandals and leaks. Doesn’t that have a negative perception overseas?

There are bad news and leaks everywhere. It is not only in a single country. It is much more important to note that financial privacy remains central even in the face of higher transparency

«The reputation of Swiss finance has risen as a result»

We are seeing internationally, which has become standard. Switzerland has become very cooperative in that regard. The trust and reputation of Swiss finance have risen as a result. I still associate Switzerland with the utmost discretion and safety.

You announced a short time ago you would be cooperating with Alpian. That is Switzerland’s first digital private bank, and it was started by Reyl. Now it should expand to Italy. What plans do you have specifically for Reyl in that context?

Because of the pandemic, the timing of the announcement was not easy, as you can imagine. The integration was a successful one, but it absorbed a tremendous amount of internal resources and capacity.

It is of little wonder that there was some fatigue afterward, but we are now in a position where we can fully leverage our operational capabilities, with a strong balance sheet, reputation, and a fantastic management team. I hope that the next few months find us having more fun. Looking back, it was a tremendous challenge.

Are you planning more takeovers?

We will certainly be looking at select targets in our key markets. That can be anything from individual teams to banks. We also have a stake in 1875 Finance, an independent Geneva asset manager, through Reyl. That allows us to play an active role in that market.

«My father was in the olive oil business»

But we must have a clearer picture of the geopolitical consequences of everything that has recently happened before we do.

You have been working in banking and finance for more than 35 years. What has been the biggest change?

The many mergers and takeovers I experienced – for sure. Some I saw, some I lived. I learned that the success of such a step is not just because of the synergies but, the quality of the integration between both companies. Integration depends primarily on people and whether they are prepared to take that step.

You come from Rome but have been living in Milan for more than 30 years. Do you feel like you have become a Northerner?

When it comes to my son’s favorite football team, – Inter Milan – yes. But apart from that, I am an enthusiastic European that is convinced of unity even if we are currently in a transitory phase and given the past was not easy, or clear.

What the EU has managed to do is impressive in the long term and it fills me with pride. The next generation should benefit from all this. In that sense, I am an Italian European.

What did you dream of when you were a child?

I grew up in an entrepreneurial family. My father was in the olive oil business. After studying, I entered banking with a view of getting experience and then managing the family company. But the diversity of the financial sector made me stay. In contrast to my father, my uncle was an equity trader – in that way, there was already a precedent in the family.

A picture of U.S. astronaut Edwin «Buzz» Aldrin on the moon hangs in your office. What do you find fascinating about it?

Two things. We always associate the picture with the first man on the moon – Neil Armstrong. But he always shied away from publicity in contrast to Aldrin who is still in the public eye today. This photo at least puts him in the history books forever, even though he wasn’t the first on the moon. You can see Armstrong in the reflection on his visor.

«John F. Kennedy started a collective mission for the American people»

The second is U.S. President John F. Kennedy’s vision. I find it fascinating that at the start of the 1960s he said that a man would be put on the moon by the end of the decade. He started a collective mission for the American people. I have always asked how we can do something like that in the corporate world.

What do you still want to achieve in life?

I want to be able to speak French – I began learning recently – to better communicate with my colleagues in Reyl. But I fear that it will take a few years before I can do that.

Tommaso Corcos began his career in 1987 at the Foreign Shareholding office of Italy’s Banca Nazionale del Lavoro (BNL). From 1990 to 2001 he held several positions at Intesa’s Asset Management, eventually acting as CIO. In 2002, he joined Fideuram as CEO of Fideuram Investimenti. From 2014 to 2020 he worked as CEO at Eurizon Capital. He was also Vice President of Allfunds Bank from 2015 to 2017. Since 2020 he has been in charge as head of the Private Banking Division of Intesa Sanpaolo. In 2020, he joined Fideuram ISPB as CEO and from January this year, he has also acted as Vice President of Intesa Sanpaolo Private Banking. In 2021, he was appointed to Reyl's Board of Directors.