Giving up on its famous banking secrecy laws, Switzerland lost its competitive edge over rival financial markets. The establishment of a crypto currency cluster in Zug now provides a welcome boost to the industry, a finews.com analysis shows.

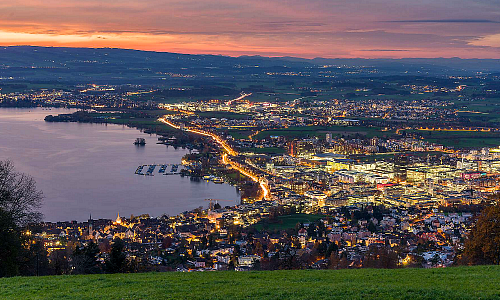

Switzerland has the best conditions for business with so-called crypto currencies: this claim doesn’t ring hollow given the dynamic surrounding the cluster of companies established in to crypto valley in central parts of the country around the city of Zug, making it the crypto capital of the world.

Finma, Switzerland financial-market supervisor, has given the fledgling industry an important impetus with a crypto-friendly set of rules. Numerous foreign providers, brokers, trading platforms and exchanges since opened up shop in Switzerland, or rather in Zug.

Bitcoin Brokerage in Swiss Banking

Bitcoin Suisse has established itself as one of the world’s best-known brokers of the booming currency and has gained the right to act on behalf of Swiss banking institutes. Finma swiftly approved the crypto asset management of Falcon Private Bank, paving the way for investments in a new asset class for the Swiss banking industry.

Crypto currencies have become entrenched in Switzerland to a degree unrivalled by other countries. Zug for instance for the first community to accept bitcoin as a means to pay taxes. Chiasso in Southern Switzerland has followed suit since.

Part of the Mainstream

SBB, the Swiss railway operator and one of the country’s biggest companies, also accepted the coin for transactions and customers of Lucerne University are welcome to pay bills with bitcoin.

Numerous organizations, promoters and networks are working to make bitcoin and other crypto currencies a mainstream topic, through the events and conferences and various initiatives.

Staying Safe

Swiss banking for decades was the top destination for wealth customers worldwide, seeking a safe place to stash away their assets. One reason for the attraction of the country was banking secrecy. This is now all but gone.

But some distinctive attributes have remained: political stability, the rule of law, a high level of security, strong standards for the protection of customers and their data, and a formidable education system providing an endless stream of talent to the industry.

And these are the factors that helped Switzerland developing a crypto cluster as well. Initiatives taken in places such as Zug or Lucerne are proof that the fintech ecosystem is steadily expanding and attracting an international clientele.

Blockchain Security Technology

Swiss banks will profit as well. Crypto currencies and the blockchain technology are based on a security mechanism that opens for transparent trading while protecting the identity of actors thanks to their crypto address.

Prominent Swiss companies are working on other forms of encryption methods, including a group containing Zuercher Kantonalbank, SIX Group, Swisscom, Incore Bank as well as Inventx, ti&m and IFZ Zug, part of Lucerne University.

Private banks could use the blockchain developed to safeguard the identity of investors to keep information about their clients protected while conforming with the demands of tax transparency rules.

A New Competitive Advantage

With the technological development making progress and initiatives launched by banks including Falcon, Vontobel, Swissquote as well as Leonteq and Cornèr, there nothing to stop a further linking up between the crypto currency industry and Swiss banking.

The intelligent and forward-looking regulation by Finma has helped the Swiss financial market to gain a competitive advantage in an area that may yet turn out to become a major business advantage rivalling the one that has gone under: banking secrecy.