Need another sign that U.S. banks have pulled far ahead of their European counterparts? A glance at payrolls proves it.

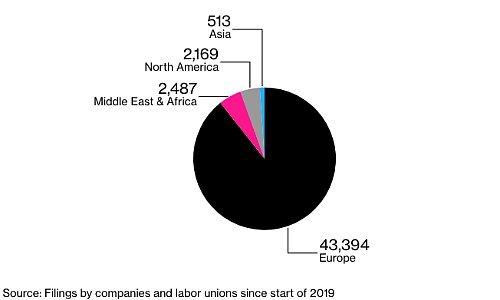

Global growth is slowing and the specter of a recession is rising – and what banks do is an early indicator for economic swings. This year, financial service firms have cut 48,500 jobs around the world, «Bloomberg» calculated. Nowhere are banks wielding the jobs ax more ferociously than in Europe.

The eurozone is of course battered by high budget deficits and record-low to negative interest rates, which have been eating into banking profits since 2015. Deutsche Bank, poised to cut 18,000 jobs in its current overhaul, leads the jobs-killing league table.

Santander, HSBC, Barclays, and Société Générale are in the process of cutting thousands of staff, and Italy's Unicredit is reportedly laboring on a spending drive which will cost 10,000 employees their job. These cuts are not included in the statistics – nor are those which the banks have not yet officially disclosed.