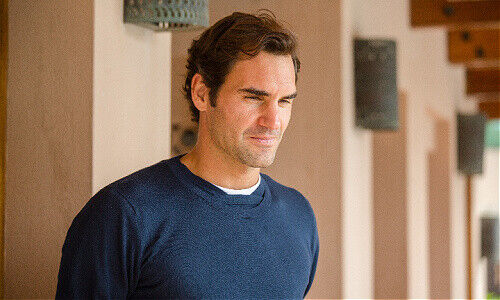

Swiss tennis ace Roger Federer’s plans to retire are shrouded in mystery, but an increasingly diverse investment portfolio offers a few clues to his next moves off the court.

Ten days shy of his 40th birthday, the world’s ninth-ranked tennis player is hunting for another Grand Slam before retreating from a 23-year professional sporting career.

Roger Federer himself seems uncertain of when, how, and where he will step down.

Top Wealth Seed

However, his plans after his professional tennis career ends are coming into clearer focus. Federer is the world’s highest-earning athlete, ahead of Cristiano Ronaldo and Lionel Messi, according to «Forbes». After winning 20 major tournaments, Federer’s estimated $700-million fortune (in German) derives in large part from lucrative ad deals with brands like Credit Suisse, Rolex, and Moet & Chandon.

The father of four maintains a close-knit and long-time athletic team – and his finances appear no different. «He’s totally protected and ring-fenced,» a Swiss wealth manager said.

Varying Game

Historically, Basel-based Sarasin maintained a banking relationship with members of Federer’s family as well as Federer himself. It isn’t clear if that relationship still exists through J. Safra Sarasin, as the bank is now known following a 2012 deal.

As Federer grew choosier on when and where he played, he was also diversifying his investments. Federer recently invested in NotCo, a plant-based food maker which raised $235 million this week, including from Jeff Bezos and Formula 1 driver Lewis Hamilton.

The biggest splash was with On Running, a Swiss-based shoe brand that last year clinched Federer as an investor as well as to design and represent «The Roger», a tennis-inspired sneaker. The 39-year-old reportedly put $50 million into On Running and stands to gain from an initial public offering. On Running didn’t respond to a request about its revenues or plans to list.

Advantage Credit Suisse

Federer won a ten-year contract with Credit Suisse in 2009 – the year he won Wimbledon for the sixth time in seven years, and the French Open. What is clear is that the Swiss bank wants to keep him well beyond his playing years. Federer is «an ideal global ambassador from Credit Suisse's perspective,» the bank freely admits on its website.

With financial stakes and real estate in and outside of Switzerland, he is also the ideal «one-bank»-type of client for the Swiss wealth manager. What role Credit Suisse has in managing Federer’s money – if any – isn’t clear. Neither J. Safra Sarasin nor Credit Suisse was prepared to comment.

Credit Suisse in turn has partnered with Federer’s foundation, which is run by Janine Haendel. A Swiss former diplomat, she ran philanthropy in Switzerland for Credit Suisse for two years before in 2010 switching to Federer's foundation, which oversees more than $20 million.

No Family Office to Serve

There doesn’t appear to be a Swiss family office for Federer in the frame. Tenro, a Swiss company that bundles his marketing rights with real estate and intellectual property, comes closest. It is overseen by Federer and managed by two Swiss lawyers who are partners at Wenger Plattner and Niederer Kraft Frey, respectively.

Federer set up a management company, Team8, in Ohio with longtime agent Tony Godsick and partners. Based in well-to-do Cleveland suburb Pepper Pike, the firm manages not only Federer’s interests but those of other star players including Coco Gauff, ranked 25th on the women’s tour.

Doubles with Team8

Team8’s details are sketchy: Godsick, who runs it, hasn’t put up more than a landing page as its website. The company, the majority owner of the Laver Cup, which is sponsored by Credit Suisse, raised eyebrows last year when it took $350,000 in U.S. government pandemic loans, which it quickly repaid.

Team8 «intends to be at the forefront in managing top athletes, and acquiring, investing in and strategically partnering with organizations and brands in the sports, media, technology and event spaces,» according to its LinkedIn page. It didn’t respond to a request for comment.

Game, Set and Match

All are long-time relationships: Federer set up his foundation in 2003 and Tenro in 2007; he partnered with Credit Suisse in 2009, and launched Team8 in 2013. The Swiss star told the «Financial Times» (behind paywall) two years ago that he doesn’t fear falling into a rut when he retires.

«Having a foundation, having four children, having some sponsors that are going to exceed my playing days, I think it will be fine.» Besides the trophy deals (Credit Suisse, Rolex, and Moet & Chandon), Federer also fronts Uniqlo, Mercedes Benz, Wilson, Barilla, Rimowa, and Netjets as well as in Switzerland coffeemaker Jura, telecom Sunrise, chocolate maker Lindt & Spruengli, and Swiss Tourism.